Talking Points:

- The Dow, S&P 500 and Nasdaq had carved out terminal wedges this past three weeks, so a Netflix beat was a perfect catalyst

- A technical break - even from a leading group for speculative interests - does not translate into trend for sentiment itself

- Where the Dollar is struggling for genuine progress, the Pound, Swiss Franc and Canadian Dollar are all producing impressive movement

See how retail traders are positioning in the S&P 500, Dow and other global indices CFDs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

Netflix Leverages a Necessary Technical Move from US Indices

There are times when the markets have no option other than to force a breakout. US equity indices found themselves in just such a position to start this week. The S&P 500, Dow and Nasdaq 100 had all carved out wedges over the past three weeks that had reached points where make-or-break was essential because they had simply run out of room to list. Add the Netflix earnings after Monday's close to the mix, and we had the necessary chemical reaction to force a break on Tuesday's open. The reporting for the first quarter was better than economists' forecasts, but the scale was certainly not ground breaking. We had to look into the details to really be impressed; and given how global and introspective sentiment is for the markets nowadays, details are not what is typically effective. However, with the proper technical setup and a little push from one of the FANG members - a key player in tech which is a benchmark sector for US equities that in turn paces global risk assets - we would end up with a notable technical move. That said, should we expect follow through?

Back to the Fundamentals with Trend Implications

It is always worth keeping track of leaders in any market or financial system. If we are looking to the health of the global economy, we keep tabs on the performance of the US, Eurozone and China. For indications for activity in the FX market, the US Dollar is consulted first and often solely. When it comes to speculative trends in our current cycle, the familiarity and outperformance of US equities sets the tone. That said, it would be a stretch to claim that conviction has been cemented for this slice of the speculative markets with Tuesday's break. Conviction does not come so cheap anymore. This is especially true when we compare a modest besting of expectations for a key tech firm's earnings compared to the vast uncertainties of trade wars, economic throttling and perhaps even military threats between the West and Russia. When we consider the uncertainties of what lies ahead against the historically expensive levels for the likes of the S&P 500, skepticism is healthy.

Pound and Swiss Franc Post Remarkable Moves

Without a clear bearing on risk trends, calling a clear a decisive view on the Dollar or Yen pairs is a disingenuous. In fact, the Greenback's persistence with its range is impressive in its own right, but few people are excited by range trading. The DXY Dollar index and EUR/USD certainly do not advocate strongly for the benchmark as the scale of the swings are shrinking and technical response is less finely tuned. However, the charts and opportunities are still interesting for the likes of the AUD/USD and GBP/USD among others. Speaking of the Cable, the Pound continues to stand out as a particularly active major this past session; but Tuesday saw a checking of the established bull trend. UK employment statistics were on tap, and the data fell short of the bullish anticipation the currency unintentionally set so high. An equally-weighted Pound Index pulled back from its post-Brexit high, while some of the crosses now find interesting technical situations (GBP/USD, EUR/GBP, GBP/AUD). Ahead, we have the run of recent UK inflation statistics which will be important to updating BoE rate forecasts. Another currency that is more active - but this time without a clear fundamental light to guide it - is the Swiss franc. EUR/CHF is just below 1.2000, threatening to retake a level the SNB famously capitulated on its monetary policy at back in January 2015. Is this stretched, a persistent trend or event market-determined? Take a look at the CHF crosses.

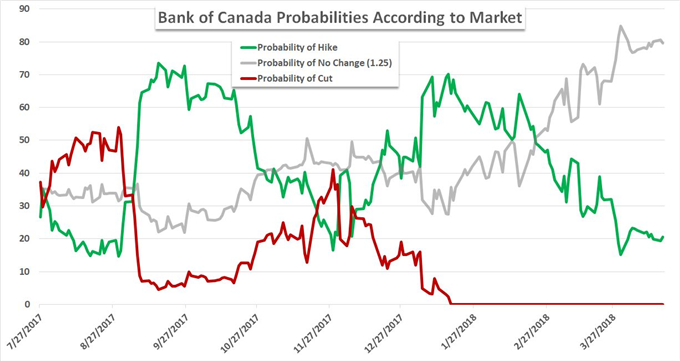

The Canadian Dollar and the BoC

Looking out over the next 24 hours, we will have to keep tabs on risk trends amid questions of trade wars as well as the tentative technical moves that have arisen without the commensurate fundamentals to secure conviction. However, there is one currency that seems like it will bring together both the technical and fundamental potential: the Canadian Dollar. On tap for Wednesday is the Bank of Canada (BoC) rate decision. This is one of the most hawkish major central banks with a few increases under its belt from the past year. The market is dubious of a move today, but it is virtually certain that another increase is due this year - and few major currencies can claim a similar fundamental favor. What makes this truly a loaded event is the activity of the Canadian Dollar itself. The currency dove through the first quarter and has subsequently retraced half of the lost ground over the past month. This is an active currency which will make it more sensitive to a balanced event risk. That said, chose your cross wisely. We discuss all of this and more in today's Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE