Talking Points:

- Risk assets are starting to take divergent paths between Yen crosses climbing, emerging markets sliding and US indices indecisive

- Dollar is struggling again to hold its lows as a wedge forms in its strong descending trend channel

- NFPs is a high profile event ahead, but its sway over risk trends and monetary policy has certainly weakened over the months

What are the DailyFX analysts' top trading ideas for 2018 and key lessons to take away from 2017? Sign up for both on the DailyFX Trading Guides page.

No Clear Trends but Prominent Technical Reminders

At the start of the week, it seemed as if the broader markets would make a serious bid for a trend. With headlines warning of a rise in protectionism (the US), faltering of monetary policy (ECB and BoJ) and troubling slip from the champion of risk sentiment (US indices on Tuesday); there was a swell of pressure that could have capsized a complacent market. Yet, through a series of key event risk - State of the Union, Fed Decision, Eurozone GDP, etc - the mood for unrestrained trend has passed. That said, the temperance of motivation has nevertheless left us with some decidedly troubling technical pictures. The S&P 500's aggressive trend break and gap lower Tuesday may not have secured bearish momentum, but it still stands as a prominent reversal on a heavily over-exposed market.

The Dollar's Technical Picture Is Even More Perilous

Where US equity indices are dangling from their highs with a prominent slip to worry complacent speculators, the Dollar finds itself struggling to avoid falling back into a year-long slide. The DXY Dollar Index and an equally-weighted synthetic index of the majors offer up a descending triangle at the bottom of an aggressive bear trend. One has much to lose but a long history of defying classic fundamentals while the other is heavily discounted to its traditional metrics of value but a market more than happy to add fuel to an already warm fire. Selecting a bearish Dollar candidate however is not particularly straightforward. EUR/USD has been a favorite punching back, but the Euro's appeal on yields is nonexistent while meaningful resistance is very much tangible. If the Dollar is to slide, chose carefully and strategically. I am predisposed to USD/CHF and USD/JPY. If the Dollar rebounds, a path-of-least-resistance range swing can work for a number of pairs including AUD/USD and USD/JPY.

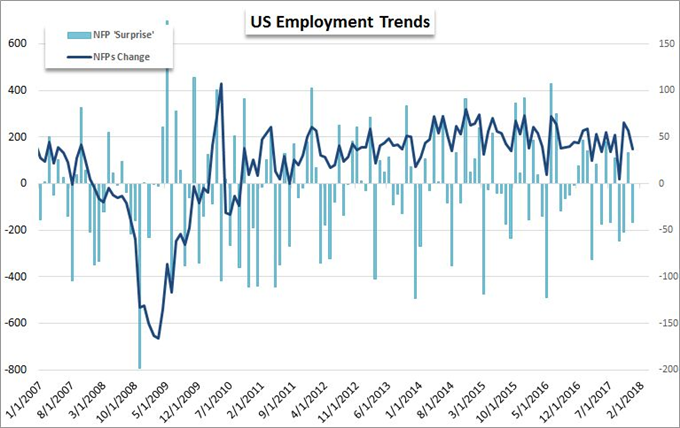

NFPs Offers an Uneven Final Thrust for the Week

There is one more prominent round of event risk to track through the end of the week: the US labor data for January. Historically, these numbers have a good record for generating volatility and even some trend from the markets. More recently, however, there has been a notable resilience to its impact. One of the key reasons the data is observed so closely is its implications for interest rate forecasts. Fed timing has become one of the most reliable themes in the financial system with US unemployment hitting near two-decade lows. Surprises in this case - bullish or bearish will not truly move the needle. Yet, there is still potential here. For the Dollar, the wage figures carry the most weight for inflation. It could also rouse risk assets as well should NFPs surprise enough to cater to recent volatility.

Outside Anticipation, Moves for Euro, Oil and Cyrpto

Not all markets are beholden to this last line of fundamental event risk in the US payroll report - though that may be supporting their momentum. Both the Euro and Pound crosses have advanced through this past session. The equally-weighted Euro index is threatening to hit multi-year highs despite the recent bearish turn from the ECB. And, despite the fading optimism in a mutually beneficial Brexit and week data this past session, the Pound was widely stronger Thursday. Particularly remarkable between these two are the EUR/JPY and GBP/JPY pushing multi-year highs against carry, risk trends and unique fundamentals. Meanwhile, oil is trying to return to its highs north of $65 and Bitcoin has hit fresh two months lows in its guided retreat for all cryptocurrencies. Would Dollar and S&P 500 both drop if there weren't event risk to track or will they make definitive moves because of the data? We discuss this in today's Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE