Talking Points:

- NFPs were not 'bad' enough to turn off risk trends or lower Fed rate forecasts, but they did lower Dollar to 8 month lows

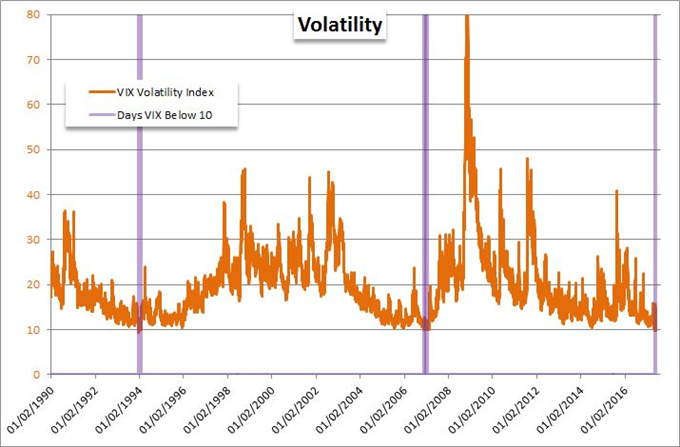

- Risk-directed assets continue to diverge and extreme positioning on VIX reminds us of the deep complacency this reflects

- Euro faces the ECB rate decision, Pound the UK election, Aussie Dollar the RBA and 1Q GDP

Trends and clear fundamental themes are in short supply nowadays. Dialing down trade time frame and following high profile event is the more adaptable approach to markets. Sign up for the live webinar coverage of the ECB, RBA and Canadian jobs on the DailyFX Webinar Calendar.

We are heading into a speculative dichotomy: June is one of the quietest trading months of the calendar year historically; but markets sporting record complacency while event risk grows in scale. Once again we return to the constant speculative question: will this time be different? That is a question for market's as a whole to decide rather than a trader to intuit through analysis. Market participants need to remain observant and adaptable when the consensus shifts. Through this past week, it seemed as if we were on pace for a deeper dive into the summer lull. We ended the period with the May NFPs. The miss was significant and drove the ICE's Dollar Index (DXY) to a fresh 8-month low, but the fundamental motivation didn't spread to the rest of the financial system. US equities advanced to a record high and the VIX volatility index finished below 10 for the seventh time in a month. The mixed speculative response should lead us to greater caution rather than relief and confidence though.

Where the S&P 500 charged to record highs through the close of this past week, the spectrum of 'risk' assets maintained an increasingly divergent course. Global equity indexes are running different paces, the high yield fixed income market holds its hesitance and carry trade remains expressly weak. This diminished correlation offers some concern as it speaks to a lack of drive. The speculative drive behind the VIX reminds us of the risk. As extreme as the volatility index's lows are, futures traders are still holding a remarkable net short exposure to the supposedly hedging product in a clearly speculative effort to stretch their reach for return. As we monitor political, economic and financial risks for sentiment triggers; the monetary policy landscape will play a considerable roll for volatility moving forward.

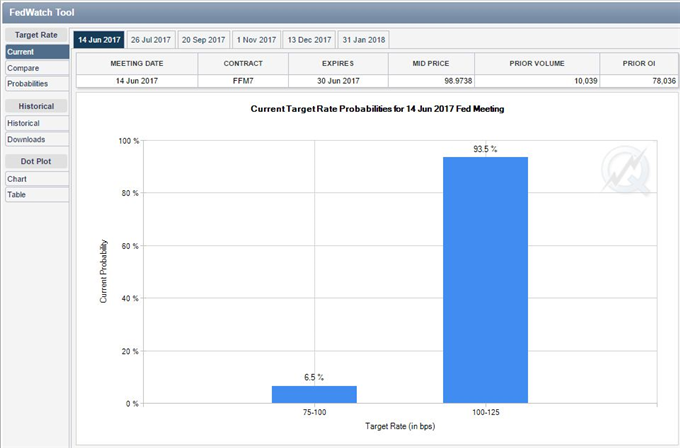

The NFPs this past week missed expectations but extended a record-breaking string of months that jobs have been added to the economy. While the Greenback did slide to a new low, it likely found little of its motivation from this event risk. Looking at interest rate expectations derived from Fed Funds futures, the market sees a 92 percent probability of a hike come June 14th. The countdown to that important policy meeting will likely throttle the Greenback against any major trends or reversal. In contrast, the ECB (European Central Bank) and RBA (Reserve Bank of Australia) rate decisions this week can generate significant FX response with the proper outcome. The Australian central bank is unlikely to change its benchmark rate, but we've seen that market has been particularly sensitive to hints and insinuation for future change. For the ECB, a much more profound debate exists. Will this leader in dovish policy start laying the track for its eventual rate hikes and stimulus scrubbing as some members have called for? This would be a profound change in direction not just for this central bank and region but for global monetary policy. We discuss the key themes of risk trends and monetary policy along with other top event risk (like the UK election) and remarkable technical standings (gold's weekly chart) in this weekend Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE