Why and how do we use the SSI in trading? View our video and download the free indicator here

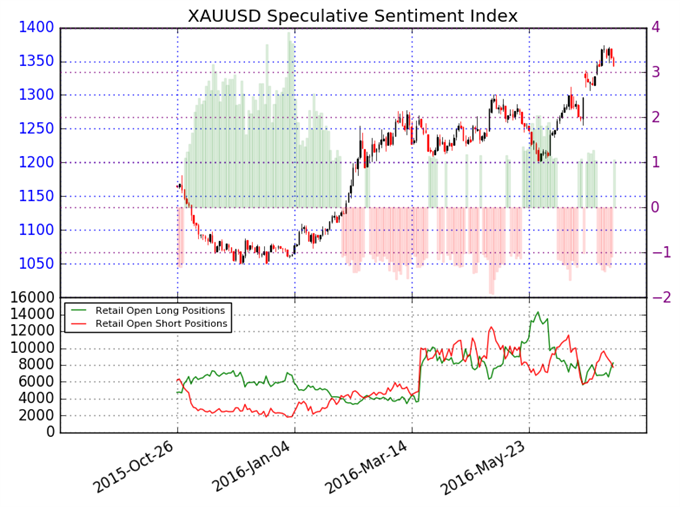

XAUUSD – Retail FX traders have mostly sold into recent Gold Price gains versus the US Dollar, and yet the most recent shift in positions shows that traders are now net-long for the first time since the precious metal set a near-term low of $1310 at the start of the month.

We most often take a contrarian view to ‘crowd’ positions—the fact that traders are net-long XAU/USD would typically make us want to be short and vice versa. Yet the recent Gold Price rally gives us pause, and indeed we would ideally see a much sharper shift towards crowd buying before calling for a much larger turnaround.

It will be important to keep an eye on the precious metal’s next steps—particularly as our technical outlook suggests further strength remains likely.

See next currency section: AUDUSD - Australian Dollar Likely to Hit Fresh Highs

--- Written by David Rodriguez, Senior Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX