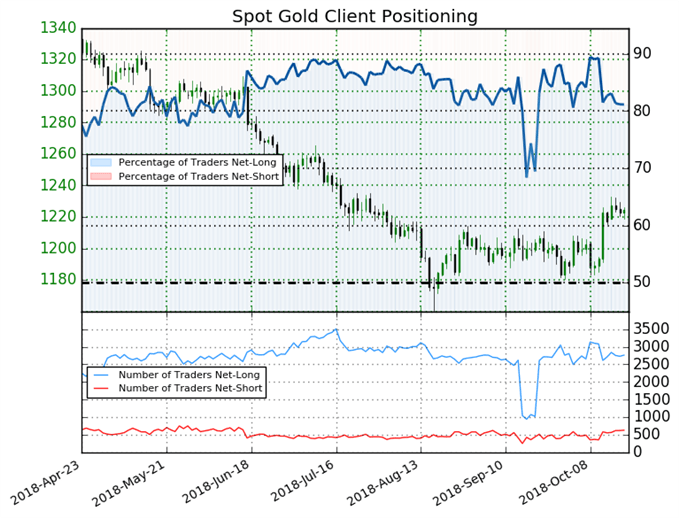

Net-Short Exposure Expanded 57% Since Last Week

Spot Gold: Retail trader data shows 81.2% of traders are net-long with the ratio of traders long to short at 4.31 to 1. The number of traders net-long is 1.6% lower than yesterday and 8.0% lower from last week, while the number of traders net-short is 3.1% higher than yesterday and 57.5% higher from last week.

To gain more insight to how we use sentiment to power our trading, join us for our weekly Trading Sentiment webinar.

Sentiment Suggests Gold Prices May Reverse

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Spot Gold price trend may soon reverse higher despite the fact traders remain net-long.

Recommended Reading: Weekly CoT Sentiment Update for Major FX, Commodities, and Indices

--- Written by Jack Schwarze, DailyFX Research