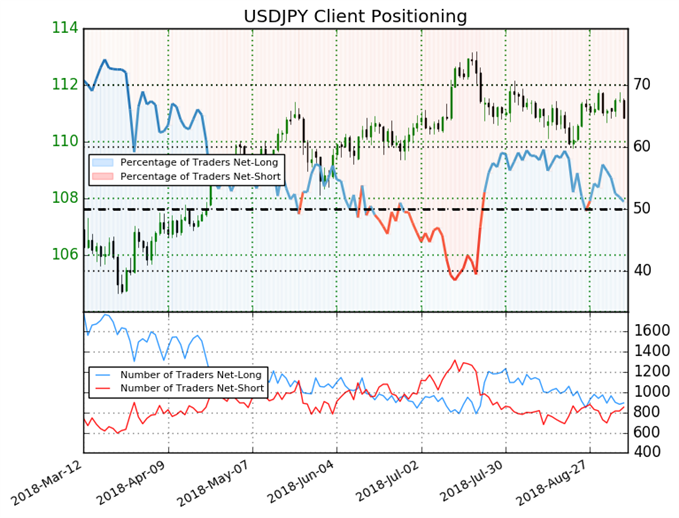

Net-Long Positions Decrease Nearly 10% From Last Week

USDJPY: Retail trader data shows 51.2% of traders are net-long with the ratio of traders long to short at 1.05 to 1. In fact, traders have remained net-long since Aug 27 when USDJPY traded near 111.071; price has moved 0.2% lower since then. The percentage of traders net-long is now its lowest since Aug 28 when USDJPY traded near 111.165. The number of traders net-long is 5.1% lower than yesterday and 9.9% lower from last week, while the number of traders net-short is 6.9% higher than yesterday and 5.4% higher from last week.

To gain more insight to how we use sentiment to power our trading, join us for our weekly Trading Sentiment webinar.

USD/JPY Trader Sentiment Proposes a Trend Reversal

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USDJPY price trend may soon reverse higher despite the fact traders remain net-long.

--- Written by Jack Schwarze, DailyFX Research