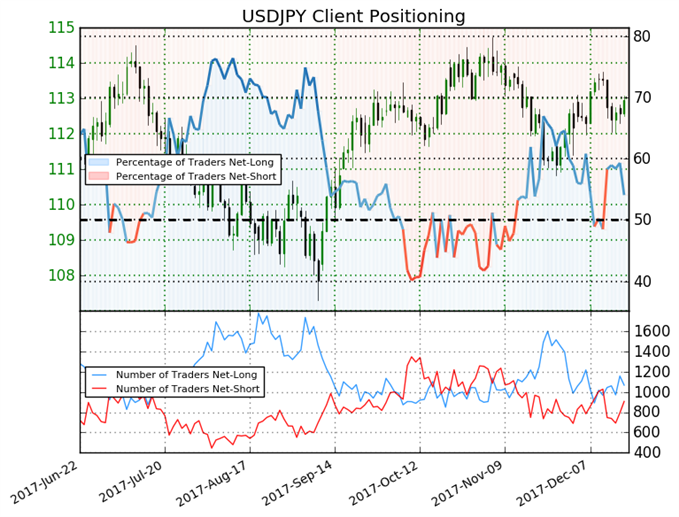

USDJPY: Retail trader data shows 54.1% of traders are net-long with the ratio of traders long to short at 1.18 to 1. The number of traders net-long is 6.1% lower than yesterday and 1.9% higher from last week, while the number of traders net-short is 10.5% higher than yesterday and 17.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USDJPY trading bias.

--- Written by Dylan Jusino, DailyFX Research