Why and how do we use the SSI in trading? View our video and download the free indicator here

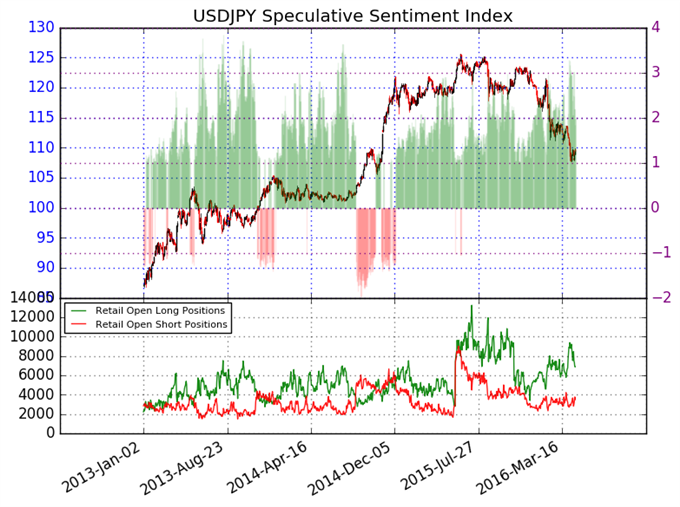

USDJPY– Retail FX traders remain extremely net-long the US Dollar versus the Japanese Yen, and a contrarian view of crowd sentiment points to further USD/JPY weakness. Indeed, our data shows there are currently 2 open retail positions long USD/JPY for every 1 short—66 percent of open interest is long.

Traders have remained net-long since the pair traded near ¥120 through late 2014. In that stretch the USD/JPY traded to decade highs near ¥126 but ultimately tumbled to recent lows below ¥108. Until we see a marked and sustained shift towards crowd selling, we see little reason to abandon our long-standing bearish trading bias for the USD/JPY.

See next currency section: XAUUSD - Gold Price Outlook Remains Bullish until this Changes

Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX