- US Dollar forecast remains broadly bearish, but next price and sentiment moves are key

- Watch for reversal potential in the Euro, Sterling, and Yen

- See full analysis below in individual currency sections

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

View individual currency sections:

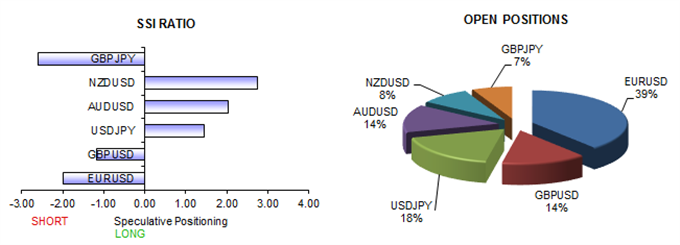

EURUSD - Euro Uptrend Remains Intact, but next Move Pivotal

GBPUSD - British Pound Forecast Depends on how it Finishes the Week

USDJPY - US Dollar Clings to Key Support versus Japanese Yen

AUDUSD - Australian Dollar Likely to Continue Lower

NZDUSD - New Zealand Dollar Forecast Firmly in Favor of Depreciation

GBPJPY - British Pound Expected to Continue Higher versus Yen

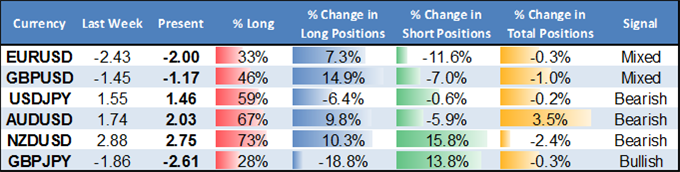

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

The US Dollar is on the cusp of its next major move. The obvious question: does it break down further or resume its much larger uptrend?

See specific US Dollar forecasts in the sections above, and sign up for future e-mail updates via this author’s e-mail distribution list.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX