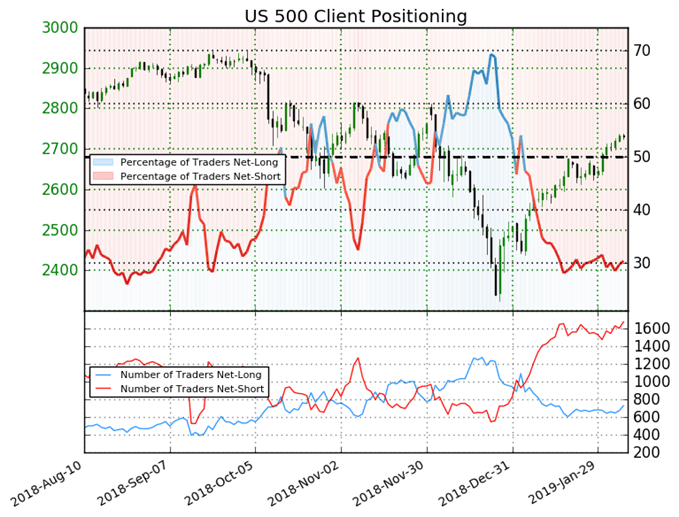

TRADERS REMAIN NET-SHORT SINCE JAN 07

US 500: Retail trader data shows 30.3% of traders are net-long with the ratio of traders short to long at 2.3 to 1. In fact, traders have remained net-short since Jan 07 when US 500 traded near 2449.4; price has moved 11.5% higher since then. The number of traders net-long is 0.1% lower than yesterday and 0.1% higher from last week, while the number of traders net-short is 7.4% higher than yesterday and 11.1% higher from last week.

For more in-depth analysis, check out the Q1 2019 Forecast for Equities

S&P 500 PRICES MAY CONTINUE TO RISE

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests US 500 prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger US 500-bullish contrarian trading bias.

--- Written by Nancy Pakbaz, CFA, DailyFX Research

Follow Nancy on Twitter @ NancyPakbazFX