Why and how do we use IG Client Sentiment in trading? See our guide and real-time data.

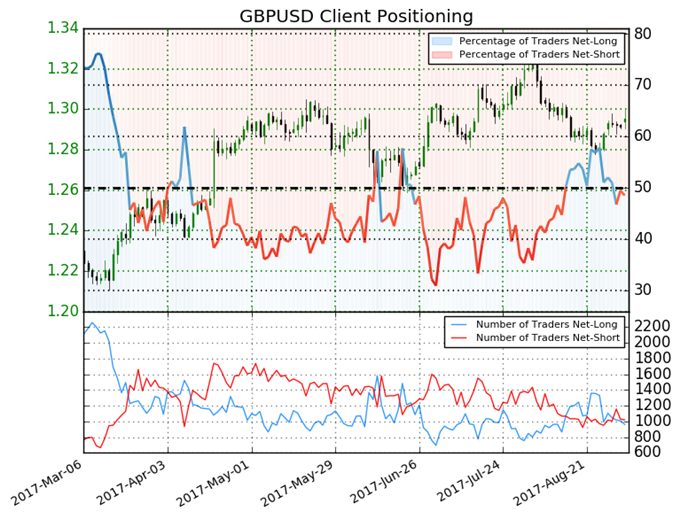

GBPUSD: Retail trader data shows 48.5% of traders are net-long with the ratio of traders short to long at 1.06 to 1. The number of traders net-long is 10.8% lower than yesterday and 13.4% lower from last week, while the number of traders net-short is 0.5% higher than yesterday and 0.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBPUSD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bullish contrarian trading bias.

See next article in this week’s report: USDJPY - Dollar Remains a Sell versus the Japanese Yen