Why and how do we use the SSI in trading? View our video and download the free indicator here

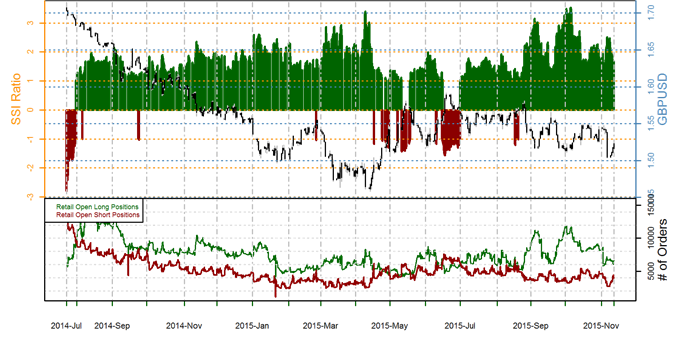

GBPUSD –Consistently one-sided retail forex trader sentiment warns that the British Pound may continue lower versus the US Dollar. A key caveat is that the recent GBP/USD move above $1.5150 leaves little notable resistance until congestion zones surrounding $1.5250 and $1.5350.

We would ideally see a break below resistance-turned-support at $1.5150 to call for further near-term weakness. And yet our retail FX trader sample shows that the majority of traders have remained net-long the GBP/USD since it traded near $1.56 in August; a contrarian view of crowd sentiment keeps our broader trading bias bearish.

See next currency section: USDCAD - US Dollar Targets Multi-Year Highs versus Canadian Dollar

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX