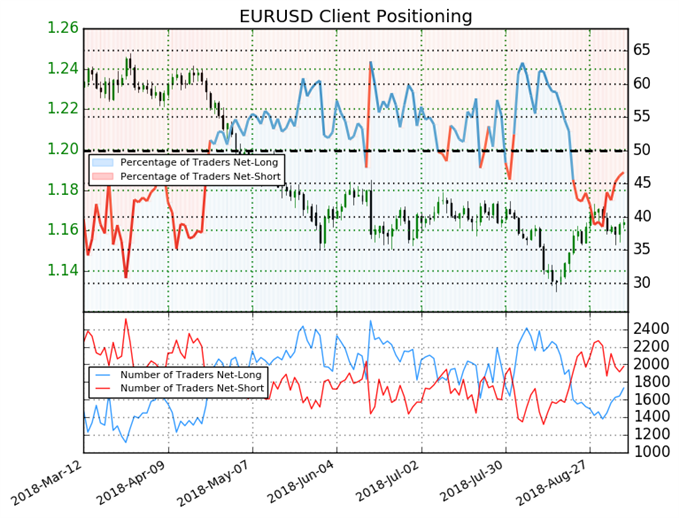

Net-Short Positions Decreased 17.7% This Week

EURUSD: Retail trader data shows 46.7% of traders are net-long with the ratio of traders short to long at 1.14 to 1. In fact, traders have remained net-short since Aug 21 when EURUSD traded near 1.14918; price has moved 1.3% higher since then. The number of traders net-long is 5.9% higher than yesterday and 22.7% higher from last week, while the number of traders net-short is 3.9% lower than yesterday and 17.7% lower from last week.

To gain more insight to how we use sentiment to power our trading, join us for our weekly Trading Sentiment webinar.

EUR/USD Sentiment Prompts a Bearish Bias

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Jake Schoenleb, DailyFX Research