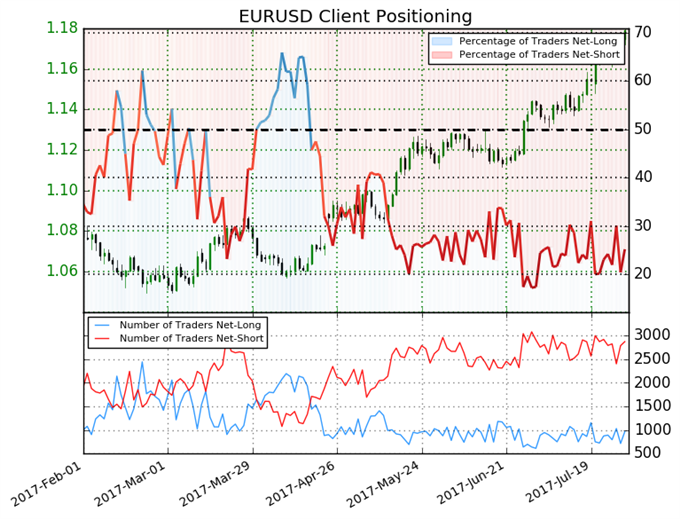

EURUSD: Retail trader data shows 25.2% of traders are net-long with the ratio of traders short to long at 2.96 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.06707; price has moved 10.5% higher since then. The number of traders net-long is 10.7% higher than yesterday and 14.8% higher from last week, while the number of traders net-short is 1.4% higher than yesterday and 6.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. We've seen a slowdown in selling, but there would need to be a much more substantial swing in sentiment before we could call for a meaningful EURUSD turnaround.

See next article in this week’s report: GBPUSD - British Pound Forecast to Rally even Further