Why and how do we use the SSI in trading? View our video and download the free indicator here

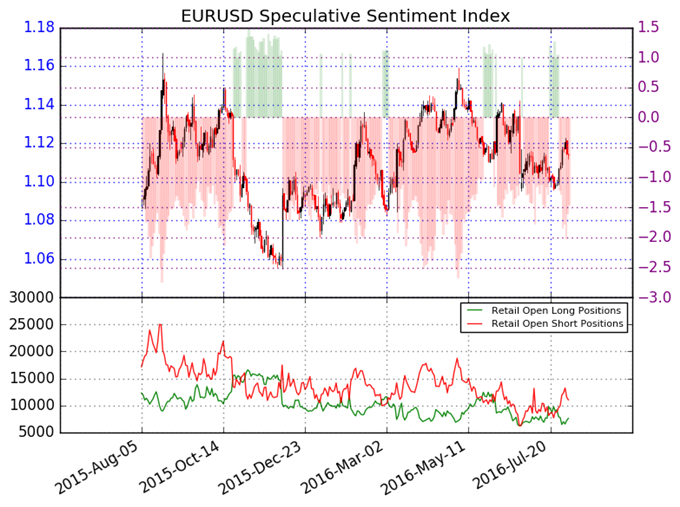

EURUSD – Retail FX traders remain net-short the Euro versus the US Dollar, and a contrarian view of crowd sentiment points to further EUR/USD gains. A minor caveat is positions have moderated since yesterday—short positions have fallen 11 percent and long positions are up 7 percent over the past 24 hours. Yet our data shows 59 percent of open positions remain short EUR, and it would take a more sustained shift in the opposite direction to change our bullish trading bias.

It will be important to watch whether the EUR/USD is able to trade above key resistance near the $1.1300 mark, while a hold above $1.1100 would keep our short-term bullish trading bias intact.

See next currency section: GBPUSD - British Pound Plunges, and Declines not Over Just Yet

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX