Summary Table

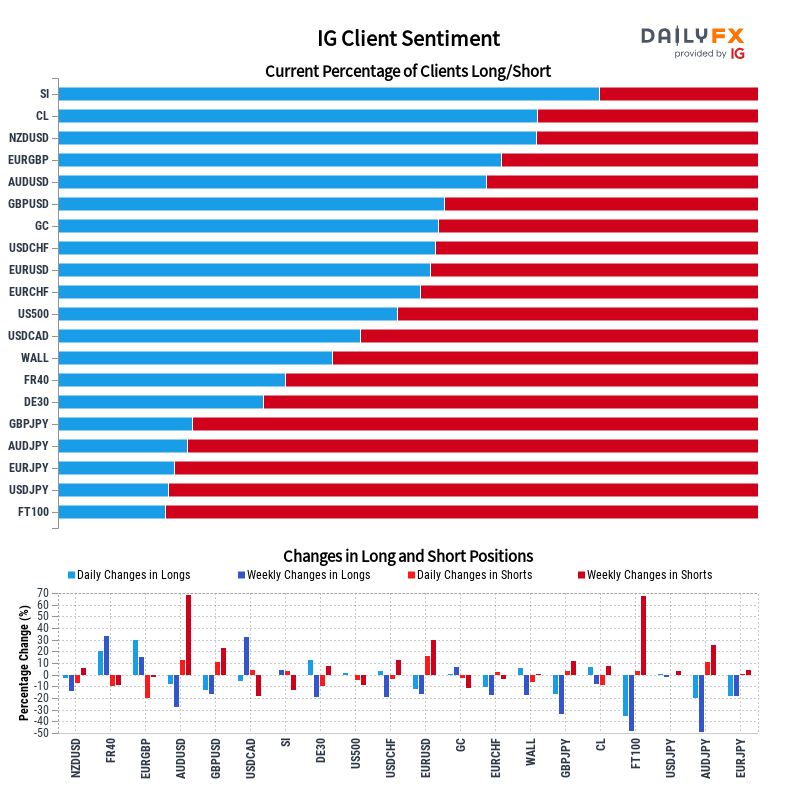

| SYMBOL | TRADING BIAS | NET-LONG% | NET-SHORT% | CHANGE IN LONGS | CHANGE IN SHORTS | CHANGE IN OI |

|---|---|---|---|---|---|---|

| AUD/JPY | BULLISH | 18.85% | 81.15% | -18.81% Daily -49.69% Weekly | 9.29% Daily 22.15% Weekly | 2.59% Daily -3.76% Weekly |

| AUD/USD | BULLISH | 61.56% | 38.44% | -6.42% Daily -27.26% Weekly | 9.77% Daily 66.35% Weekly | -0.79% Daily -7.18% Weekly |

| Oil - US Crude | MIXED | 67.59% | 32.41% | 5.49% Daily -8.57% Weekly | -6.84% Daily 7.53% Weekly | 1.15% Daily -3.91% Weekly |

| Germany 40 | MIXED | 29.79% | 70.21% | 17.53% Daily -14.92% Weekly | -9.51% Daily 6.34% Weekly | -2.86% Daily -1.03% Weekly |

| EUR/CHF | BULLISH | 51.70% | 48.30% | -10.88% Daily -19.32% Weekly | 2.58% Daily -3.40% Weekly | -4.85% Daily -12.34% Weekly |

| EUR/GBP | BEARISH | 62.09% | 37.91% | 26.57% Daily 12.42% Weekly | -17.54% Daily -2.64% Weekly | 5.23% Daily 6.19% Weekly |

| EUR/JPY | BULLISH | 17.58% | 82.42% | -7.84% Daily -14.02% Weekly | -0.15% Daily 3.12% Weekly | -1.60% Daily -0.37% Weekly |

| EUR/USD | BULLISH | 53.39% | 46.61% | -10.37% Daily -15.25% Weekly | 13.99% Daily 27.65% Weekly | -0.46% Daily 0.49% Weekly |

| France 40 | BEARISH | 31.07% | 68.93% | 2.94% Daily 24.19% Weekly | -5.53% Daily -5.22% Weekly | -3.05% Daily 2.31% Weekly |

| FTSE 100 | BULLISH | 15.79% | 84.21% | -34.76% Daily -45.36% Weekly | 2.79% Daily 62.43% Weekly | -5.77% Daily 23.86% Weekly |

| GBP/JPY | BULLISH | 20.43% | 79.57% | -11.88% Daily -30.88% Weekly | 0.37% Daily 11.13% Weekly | -2.40% Daily -1.15% Weekly |

| GBP/USD | BULLISH | 55.09% | 44.91% | -13.83% Daily -17.95% Weekly | 6.91% Daily 24.22% Weekly | -5.61% Daily -3.19% Weekly |

| Gold | MIXED | 52.97% | 47.03% | -1.32% Daily 6.00% Weekly | 0.19% Daily -11.70% Weekly | -0.62% Daily -3.13% Weekly |

| NZD/USD | MIXED | 68.18% | 31.82% | -2.96% Daily -14.69% Weekly | -5.08% Daily 8.39% Weekly | -3.65% Daily -8.49% Weekly |

| Silver | MIXED | 77.05% | 22.95% | -1.36% Daily 3.14% Weekly | 4.05% Daily -13.11% Weekly | -0.17% Daily -1.10% Weekly |

| US 500 | BEARISH | 48.73% | 51.27% | 4.62% Daily 0.40% Weekly | -5.21% Daily -9.23% Weekly | -0.66% Daily -4.78% Weekly |

| USD/CAD | MIXED | 42.67% | 57.33% | -9.52% Daily 31.27% Weekly | 2.97% Daily -20.36% Weekly | -2.76% Daily -4.30% Weekly |

| USD/CHF | MIXED | 55.94% | 44.06% | 6.06% Daily -14.19% Weekly | -7.21% Daily 9.04% Weekly | -0.23% Daily -5.30% Weekly |

| USD/JPY | BEARISH | 15.96% | 84.04% | 4.11% Daily 3.15% Weekly | -0.34% Daily 2.12% Weekly | 0.34% Daily 2.29% Weekly |

| Wall Street | MIXED | 37.23% | 62.77% | 1.49% Daily -22.78% Weekly | -3.34% Daily 5.15% Weekly | -1.59% Daily -7.33% Weekly |

AUD/JPY

AUD/JPY: Retail trader data shows 18.85% of traders are net-long with the ratio of traders short to long at 4.30 to 1. The number of traders net-long is 18.81% lower than yesterday and 49.69% lower from last week, while the number of traders net-short is 9.29% higher than yesterday and 22.15% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bullish contrarian trading bias.

AUD/USD

AUD/USD: Retail trader data shows 61.56% of traders are net-long with the ratio of traders long to short at 1.60 to 1. The number of traders net-long is 6.42% lower than yesterday and 27.26% lower from last week, while the number of traders net-short is 9.77% higher than yesterday and 66.35% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Oil - US Crude

Oil - US Crude: Retail trader data shows 67.59% of traders are net-long with the ratio of traders long to short at 2.09 to 1. The number of traders net-long is 5.49% higher than yesterday and 8.57% lower from last week, while the number of traders net-short is 6.84% lower than yesterday and 7.53% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Oil - US Crude trading bias.

Germany 40

Germany 40: Retail trader data shows 29.79% of traders are net-long with the ratio of traders short to long at 2.36 to 1. The number of traders net-long is 17.53% higher than yesterday and 14.92% lower from last week, while the number of traders net-short is 9.51% lower than yesterday and 6.34% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Germany 40 prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed Germany 40 trading bias.

EUR/CHF

EUR/CHF: Retail trader data shows 51.70% of traders are net-long with the ratio of traders long to short at 1.07 to 1. The number of traders net-long is 10.88% lower than yesterday and 19.32% lower from last week, while the number of traders net-short is 2.58% higher than yesterday and 3.40% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/CHF prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/CHF price trend may soon reverse higher despite the fact traders remain net-long.

EUR/GBP

EUR/GBP: Retail trader data shows 62.09% of traders are net-long with the ratio of traders long to short at 1.64 to 1. The number of traders net-long is 26.57% higher than yesterday and 12.42% higher from last week, while the number of traders net-short is 17.54% lower than yesterday and 2.64% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bearish contrarian trading bias.

EUR/JPY

EUR/JPY: Retail trader data shows 17.58% of traders are net-long with the ratio of traders short to long at 4.69 to 1. The number of traders net-long is 7.84% lower than yesterday and 14.02% lower from last week, while the number of traders net-short is 0.15% lower than yesterday and 3.12% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/JPY-bullish contrarian trading bias.

EUR/USD

EUR/USD: Retail trader data shows 53.39% of traders are net-long with the ratio of traders long to short at 1.15 to 1. The number of traders net-long is 10.37% lower than yesterday and 15.25% lower from last week, while the number of traders net-short is 13.99% higher than yesterday and 27.65% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

France 40

France 40: Retail trader data shows 31.07% of traders are net-long with the ratio of traders short to long at 2.22 to 1. The number of traders net-long is 2.94% higher than yesterday and 24.19% higher from last week, while the number of traders net-short is 5.53% lower than yesterday and 5.22% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests France 40 prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current France 40 price trend may soon reverse lower despite the fact traders remain net-short.

FTSE 100

FTSE 100: Retail trader data shows 15.79% of traders are net-long with the ratio of traders short to long at 5.33 to 1. The number of traders net-long is 34.76% lower than yesterday and 45.36% lower from last week, while the number of traders net-short is 2.79% higher than yesterday and 62.43% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests FTSE 100 prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger FTSE 100-bullish contrarian trading bias.

GBP/JPY

GBP/JPY: Retail trader data shows 20.43% of traders are net-long with the ratio of traders short to long at 3.89 to 1. The number of traders net-long is 11.88% lower than yesterday and 30.88% lower from last week, while the number of traders net-short is 0.37% higher than yesterday and 11.13% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/JPY-bullish contrarian trading bias.

GBP/USD

GBP/USD: Retail trader data shows 55.09% of traders are net-long with the ratio of traders long to short at 1.23 to 1. The number of traders net-long is 13.83% lower than yesterday and 17.95% lower from last week, while the number of traders net-short is 6.91% higher than yesterday and 24.22% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

Gold

Gold: Retail trader data shows 52.97% of traders are net-long with the ratio of traders long to short at 1.13 to 1. The number of traders net-long is 1.32% lower than yesterday and 6.00% higher from last week, while the number of traders net-short is 0.19% higher than yesterday and 11.70% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

NZD/USD

NZD/USD: Retail trader data shows 68.18% of traders are net-long with the ratio of traders long to short at 2.14 to 1. The number of traders net-long is 2.96% lower than yesterday and 14.69% lower from last week, while the number of traders net-short is 5.08% lower than yesterday and 8.39% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed NZD/USD trading bias.

Silver

Silver: Retail trader data shows 77.05% of traders are net-long with the ratio of traders long to short at 3.36 to 1. The number of traders net-long is 1.36% lower than yesterday and 3.14% higher from last week, while the number of traders net-short is 4.05% higher than yesterday and 13.11% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Silver trading bias.

US 500

US 500: Retail trader data shows 48.73% of traders are net-long with the ratio of traders short to long at 1.05 to 1. The number of traders net-long is 4.62% higher than yesterday and 0.40% higher from last week, while the number of traders net-short is 5.21% lower than yesterday and 9.23% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests US 500 prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current US 500 price trend may soon reverse lower despite the fact traders remain net-short.

USD/CAD

USD/CAD: Retail trader data shows 42.67% of traders are net-long with the ratio of traders short to long at 1.34 to 1. The number of traders net-long is 9.52% lower than yesterday and 31.27% higher from last week, while the number of traders net-short is 2.97% higher than yesterday and 20.36% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.

USD/CHF

USD/CHF: Retail trader data shows 55.94% of traders are net-long with the ratio of traders long to short at 1.27 to 1. The number of traders net-long is 6.06% higher than yesterday and 14.19% lower from last week, while the number of traders net-short is 7.21% lower than yesterday and 9.04% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CHF prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CHF trading bias.

USD/JPY

USD/JPY: Retail trader data shows 15.96% of traders are net-long with the ratio of traders short to long at 5.27 to 1. The number of traders net-long is 4.11% higher than yesterday and 3.15% higher from last week, while the number of traders net-short is 0.34% lower than yesterday and 2.12% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse lower despite the fact traders remain net-short.

Wall Street

Wall Street: Retail trader data shows 37.23% of traders are net-long with the ratio of traders short to long at 1.69 to 1. The number of traders net-long is 1.49% higher than yesterday and 22.78% lower from last week, while the number of traders net-short is 3.34% lower than yesterday and 5.15% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Wall Street prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed Wall Street trading bias.