Gold Price Forecast Overview:

- Gold prices have struggled through September after being one of the best performing assets since global financial markets bottomed out in March.

- With expectations for fresh fiscal stimulus low, US inflation expectations have receded, allowing US real yields to turn higher. As a result, the fundamental bedrock of the gold price rally has been tempered.

- According to the IG Client Sentiment Index, gold prices are on mixed footing.

Gold Prices Turn Higher on US Political News

Gold prices are closing the first full week of October near the weekly highs, thanks in part to news that the Trump administration and Congressional Democrats may indeed get a fiscal stimulus deal across the finish line prior to the November 3 elections. The increasing odds of a fiscal package, thanks to rumors that the Trump administration was readying a $1.8 trillion offer, have helped stoke a drop in US real yields, which typically proves bullish for gold prices.

Real Yields Helping Gold Gain

The feedback mechanism for the fiscal stimulus news to gold prices is as follows: increasing odds for more fiscal stimulus equate to a greater pace of deficit spending; a greater pace of deficit spending increases inflation expectations; higher inflation expectations in context of short-term rates pinned near zero thanks to the Federal Reserve means US real yields fall. If rising real yields proved harmful for gold prices throughout August and September, then the latest development of lower real yields has proven to help prop up the gold price rally.

Gold Volatility Flat, but Gold Prices Don’t Suffer

Gold prices have a relationship with volatility unlike other asset classes. While other asset classes like bonds and stocks don’t like increased volatility – signaling greater uncertainty around cash flows, dividends, coupon payments, etc. – gold tends to benefit during periods of higher volatility. Heightened uncertainty in financial markets due to increasing macroeconomic tensions increases the safe haven appeal of gold.

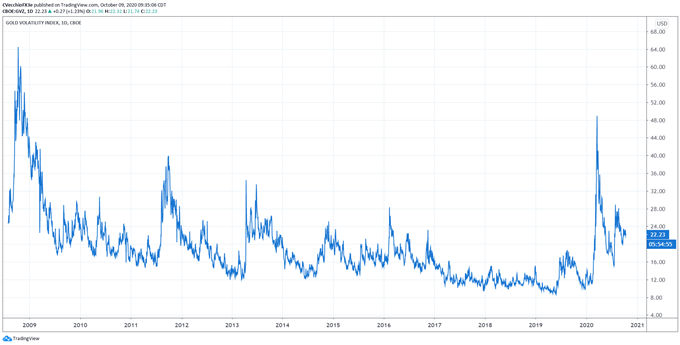

GVZ (Gold Volatility) Technical Analysis: Daily Price Chart (October 2008 to October 2020) (Chart 1)

Gold volatility has steadied over the past week, trailing the gains seen in gold prices. As such, there is an atypical state of negative correlations. Gold volatility (as measured by the Cboe’s gold volatility ETF, GVZ, which tracks the 1-month implied volatility of gold as derived from the GLD option chain) is trading at 22.23. The 5-day correlation between GVZ and gold prices is -0.57 while the 20-day correlation is -0.83; one week ago, on October 2, the 5-day correlation was 0.55 and the 20-day correlation was -0.79.

Our longstanding axiom holds: “given the current environment, falling gold volatility is not necessarily a negative development for gold prices, whereas rising gold volatility has almost always proved bullish; in the same vein, gold volatility simply trending sideways is more positive than negative for gold prices.”

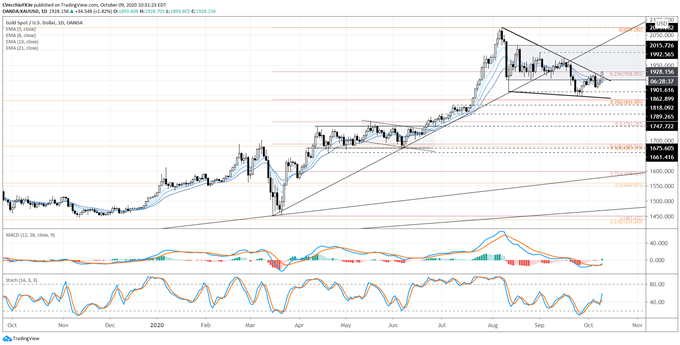

Gold Price Technical Analysis: Daily Chart (October 2019 to October 2020) (Chart 2)

Gold prices may be finding clarity after weeks trapped in a bullish falling wedge consolidation since the August high. Fresh weekly and monthly highs have been established, clearing out the bearish outside engulfing bar on October 6. To this end, the series of ‘lower highs and lower lows’ appears to have ended now that the downtrend from the August and September swing highs is breaking.

Returning back to the sideways range support established from mid-August to late-September between 1901.62 and 2015.73 was an omen that a false breakdown was afoot; this further reinforces the possibility that gold prices are about to turn higher in a meaningful way.

At present time, gold price momentum is gathering steam, with daily MACD trending higher albeit below its signal line and Slow Stochastics rising above its median line, now in bullish territory. holding in bearish territory (albeit trending higher). Gold prices are above their daily 5-, 8-, 13-, and 21-EMA envelope, which is yet in full bullish sequential order.

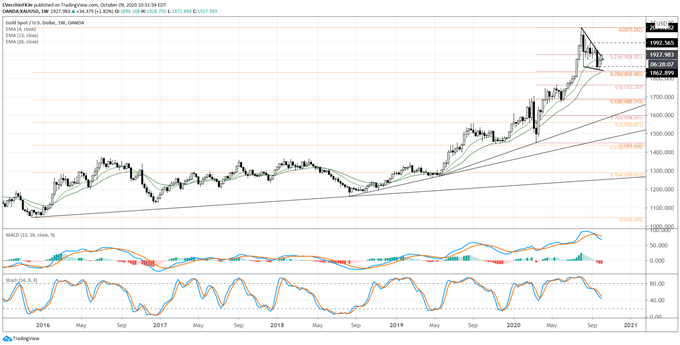

Gold Price Technical Analysis: Weekly Chart (June 2011 to October 2020) (Chart 3)

It’s been previously noted that “a loss of the August low at 1862.90 would be a very important development insofar as redefining the recent consolidation as a topping effort rather than a bullish continuation effort.” That the August low was retaken and prices have returned back into the sideways range, but moreover, having started to breakout of the bullish falling wedge, suggests that we may be witnessing the early stages of the next leg higher.

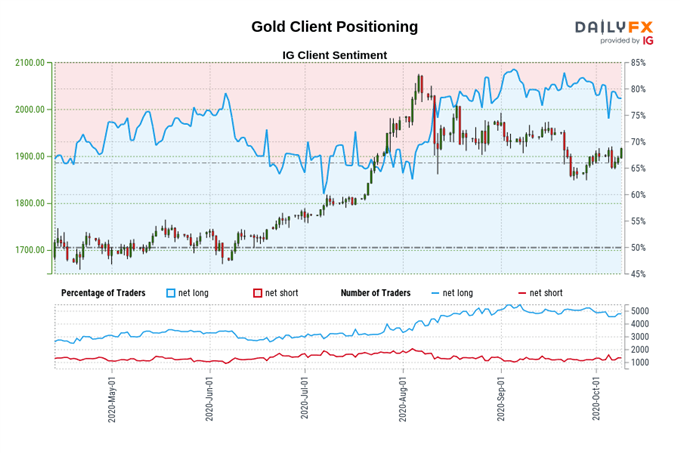

IG Client Sentiment Index: Gold Price Forecast (October 9, 2020) (Chart 4)

Gold: Retail trader data shows 75.09% of traders are net-long with the ratio of traders long to short at 3.01 to 1. The number of traders net-long is 9.42% lower than yesterday and 8.60% lower from last week, while the number of traders net-short is 11.07% higher than yesterday and 13.67% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist