Gold Price Technical Highlights:

- Gold price trying to lift off confluent support

- Support can be used as line-in-the sand for would-be longs

Gold price trying to lift off confluent support

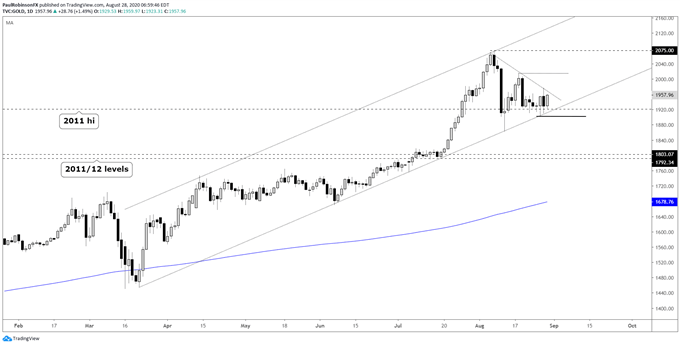

After spiraling into a top earlier this month, gold has become tamer as it digests the surge from March. Currently, there is good support to lean on via the 2011 high and the trend-line from March. This confluent intersection support from varying angles makes for a nice line-in-the-sand.

Stay above and the outlook is neutral to bullish. There may be some more chopping around before gold tries to run again, but this wouldn’t be a bad thing as it further draws in another fresh round of buyers. The back-and-forth we have seen since the high is forming a wedge pattern that suggests we may indeed see another run develop sooner rather than later.

The first hurdle to overcome is 2015 followed by the high at 2075. This may take a bit of time, so patience may be required before the momentum crowd is drawn back in. Looking at the downside, this week’s low at 1902 should hold on a closing basis if the top-side is to remain intact.

A closing daily candle below 1902 is seen as having the August low of 1863 at risk, and below there another set of major levels from 2011/12 (~1800) will start to come into play. That would be another critical longer-term spot for gold to hold should it reach it.

In sum, gold is sitting on good support and it appears to be an attractive spot from a risk/reward perspective for would-be longs. A break below though could get things rolling downhill a bit, giving short-term shorts the upper hand.

Gold Price Daily Chart (on good support, wedging)

Gold Price Chart by TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX