GOLD FORECAST: SPOT GOLD PRICES (XAU/USD) SLIP TOWARD CHART SUPPORT

- The price of gold has receded from recent highs as trader concern over the novel coronavirus outbreak in China and its likely adverse impact on global GDP growth dissipate

- Gold price action has potential to slide further as risk appetite keeps recovering alongside falling market volatility

- Check out these top gold trading strategies and tips for key insight on how to trade gold

Gold prices have climbed considerably into the new decade owing to various fundamental factors such as falling sovereign yields and surging liquidity while global central banks inflate their balance sheets.

More recently, the price of gold has responded predominantly to market volatility stemming from the international public health crisis due to a new coronavirus outbreak that has infected over 45,000 people worldwide so far.

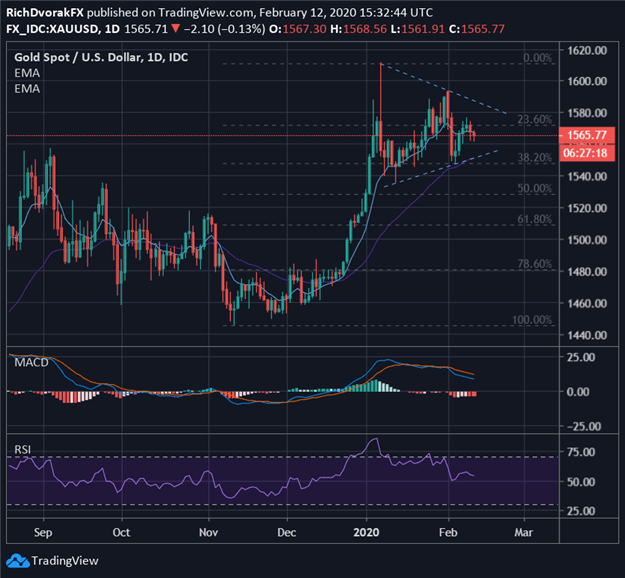

XAU/USD – GOLD PRICE CHART: DAILY TIME FRAME (AUGUST 2019 TO FEBRUARY 2020)

Chart created by @RichDvorakFX with TradingView

While the vast majority of confirmed coronavirus cases are isolated to China, this is to be expected seeing that the Asian nation has been on lockdown to prevent its spread.

In turn, this has boosted investor demand for safe-haven assets like gold as economic activity across the world’s second largest economy comes to a standstill and begins to weigh negatively on global GDP growth expectations.

The market’s knee-jerk reaction could now be unwinding, however, as the rate of new coronavirus cases decelerates.

Gold price action has correspondingly drifted lower since the beginning of the month and has potential to come under additional selling pressure if coronavirus-induced market angst dwindles further.

This brings to focus rising trendline support extended from the January 14 and February 05 intraday lows, which could perhaps serve as a downside target for gold price bears.

This technical support level roughly around the $1,550 price is juxtaposed with gold’s 34-day exponential moving average and its 38.2% Fibonacci retracement of gold’s bullish leg from November 12 to January 08.

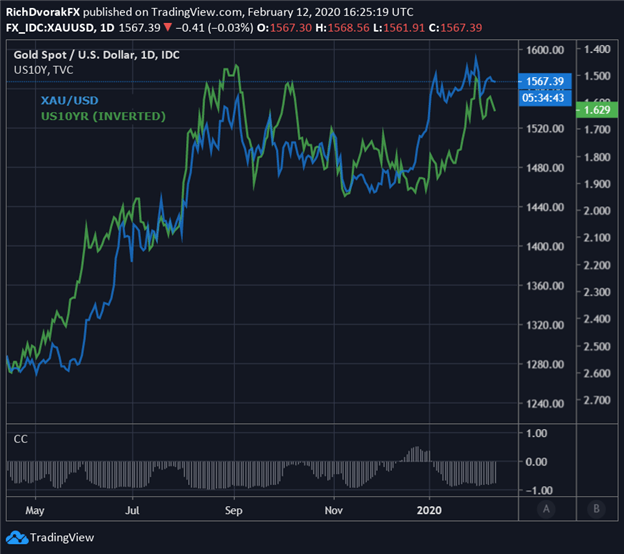

XAU/USD – GOLD PRICE CHART & TEN-YEAR US TREASURY YIELD: DAILY TIME FRAME (APRIL 2019 TO FEBRUARY 2020)

Chart created by @RichDvorakFX with TradingView

That said, the broader direction of gold will likely continue to track interest rates on government debt like the ten-year US Treasury.

If worry over the coronavirus outbreak in China rises again, the precious metal may come back into demand, which may be preceded by a move higher in Treasuries.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight