To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

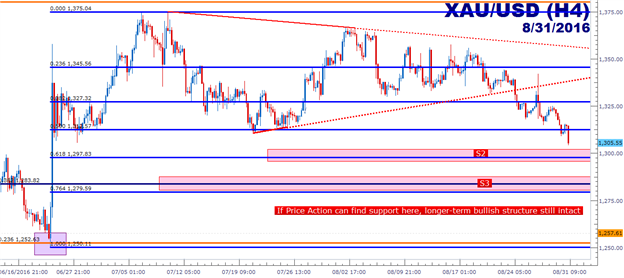

- Gold Technical Strategy: Longer-term up-trend still alive, near-term bearish on Strong USD/higher U.S. rate expectations.

- Gold prices are continuing to face pressure as rate hike bets further firm the Dollar.

- If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

In our last article, we looked at the uptrend in Gold prices after having just moved down to support. But as we warned, with the Jackson Hole Economic Symposium later in the week and after numerous Fed members had already come-out to talk up higher rates, Gold prices could face further pressure as rate hike bets for the United States continued to increase.

And since Friday’s outlay of Federal Reserve dialog, USD strength has been all the vogue as markets have been pricing-in a higher probability of a rate hike from the Fed in the coming months. But this isn’t the first time that this has happened is it? Even this year, we’ve seen a very similar scenario play-out in April/May after the Federal Reserve a) posed a less dovish statement at their non-press conference rate decision and b) saw a continuation of hawkish dialog after the meeting as multilpe Fed members talked up higher rates. Gold prices have swung along with these rate expectations; with more than $100 coming off in the month, bouncing off of a key support level at $1,200 before ascending to fresh 2-year highs.

With USD-strength showing prospects of continuation, Gold prices may be in for a deeper retracement before bullish positions become attractive again. In our last article, we outlined three different support zones to watch for price action to move towards. These support levels integrate a Fibonacci retracement that can be found by charting the major move from the swing-low of $1,250.11 to the high of $1,375.04. The 50% retracement of this move at $1,312.57 had provided prior support in the month of July, and now price action is in the process of sliding below this level.

This highlights deeper support levels for potential top-side reentries should this current bout of USD-strength continue. At the level of $1,297.59 we have the 61.8% retracement of that same major move, and with the psychological level at $1,300, this could produce a ‘zone’ of support for traders to watch. And just below that, we have another confluent zone of support with two different Fibonacci levels around the ~$1,280 area.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX