Gold Price & Silver Technical Outlook:

- Gold price on the verge of breaking August trend-line

- Silver leading the way lower, looking to 14

See what intermediate-term fundamental drivers and technical signposts our team of analysts are watching in the DailyFX Q2 Gold Forecast.

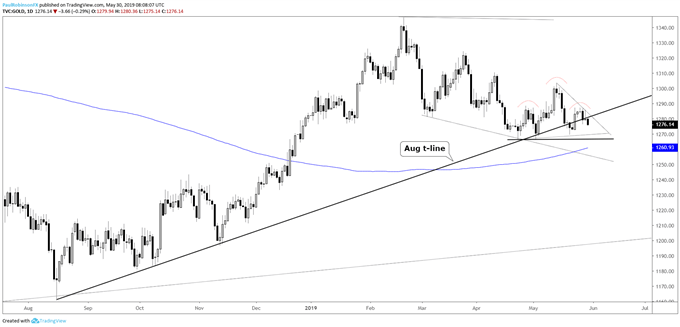

Gold price on the verge of breaking August trend-line

Gold has been clinging to the trend-line from August for the better part of the past 5 weeks, with it only once lifting off it with any meaning. That may soon change as the trend from the February high looks poised to continue on with gold breaking support levels here shortly.

There are a couple of ways of looking at the chart here. The first is a continuation-style head-and-shoulders pattern where the neckline lies not too far below near the 1266 double-bottom low from late-April, early-May. Another view is that price action in recent weeks is creating a wedge.

In either event, whether the price sequence is viewed as a continuation-style H&S formation or a wedge, the outcome could be the same. Trade below 1266 and heavy pressure will be put on the 200-day at 1261 to hold. Without the 200 having anything to help it out (no price confluence) and considering the more important break of the August trend-line, it seems likely it may only turn out to be a minor bump for shorts.

The larger target on the downside remains the bottom-side trend-line of the multi-year wedge. Depending on how one draws the underside trend-line the broader target is in the vicinity of 1220/00. To turn the picture bullish, at this juncture we will need to see significant work done on the upside.

Check out the IG Client Sentiment page to see how changes in trader positioning can help signal the next price move in gold and other major markets and currencies.

Gold Price Daily Chart (Looks ready to leave behind Aug t-line)

Gold Price Weekly Chart (Targeting lower end of wedge)

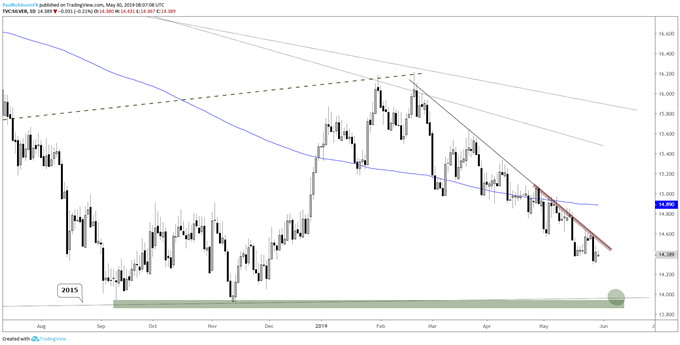

Silver leading the way lower, looking to 14

The other day silver once again validated the trend-line running down off the February high with another solid drop following a retest. Stay below the trend-line and the outlook will remain neutral at best in the near-term, but broadly bearish.

It’s the clear leader on the downside here and there isn’t much in the way of support to prevent silver from soon trading to 14. Down there we might see a lift as long-term support arrives by way of last year’s lows and a trend-line from 2015, but until then sellers should remain firmly in charge.

Silver Price Daily Chart (looks headed to 14)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX