Gold/Silver Technical Highlights:

- Gold price sitting on important trend-line from August

- Silver is trading at confluent support, pattern trigger

See what intermediate-term fundamental drivers and technical signposts our team of analysts are watching in the DailyFX Q2 Gold Forecast.

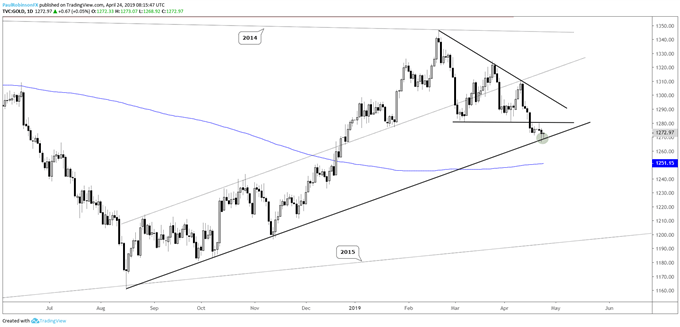

Gold price sitting on important trend-line from August

Last week, gold broke below horizontal support at 1281, helping pave the way lower out of a descending wedge formation. However, a caveat to the break was the close proximity of the August trend-line, which in the past 24-hour period has come under fire but is thus far holding.

The angle at which the line is currently drawn off the August low has a few inflection points and yesterday’s initial ‘respect’ paid (smallish reversal) suggests this it is the correct angle to work with. Trend-lines can be tricky at times, which is why if there is a parallel to it (dotted line) which also has a lot of turning points, it strengthens the notion that you are working with the right angle.

A break below could quickly have price running lower to the 200-day at 1251. It will require an aggressive move and likely a fair amount of time, but the end target for this move is the bottom of the long-term wedge on the weekly time-frame, somewhere in the very low 1200s depending on timing of arrival (line is angled higher making it a moving target).

Support is to be respected until broken. For now, gold could continue to hold trend-line support and could see its way higher. The first roadblock to watch is 1281, the bottom of the wedge. But even if gold were to recapture this level and trade back inside the wedge pattern, the trend since the February high still remains lower and favors seeing another lower high develop. In any event, whether now or later, gold looks headed for more weakness.

Check out the IG Client Sentiment page to see how changes in trader positioning can help signal the next price move in gold and other major markets and currencies.

Gold Daily Chart (at t-line support)

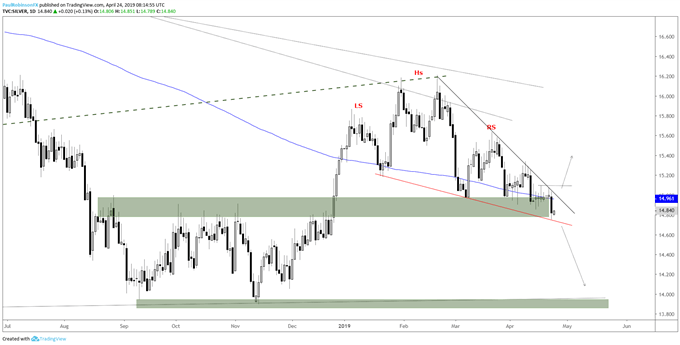

Silver is trading at confluent support, pattern trigger

A once very clear head-and-shoulders pattern has become uglier as price dwindles lower. This is largely because of the amount of significant support which has run together in a relatively tight range. The 200-day (now broken) and top of the bottoming range from last year have kept silver from sinking.

The bouncing around has price funneling lower in what has the H&S patter morphing into a falling wedge. The bottom of the wedge and neckline of the either pattern is one and the same angle of support. So regardless of what you want to call it, a break below will have silver in an ‘air pocket’ down to around 14. On the flip-side, the bullish alternate is that the falling wedge triggers with a rally above the top-side trend-line and silver squeezes higher. While this is viewed as the lower probability scenario it can’t be ruled out.

Silver Daily Chart (H&S neckline/bottom of falling wedge)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX