Gold/Silver Technical Highlights:

- Gold sitting on support, confluence is nearing

- Consolidation in trend suggests higher, but needs to do so soon

- Silver is trickier; at t-line support, but above is t-line resistance

See what drivers DailyFX analysts expect to move Gold in the weeks ahead in the Q1 Gold Forecast.

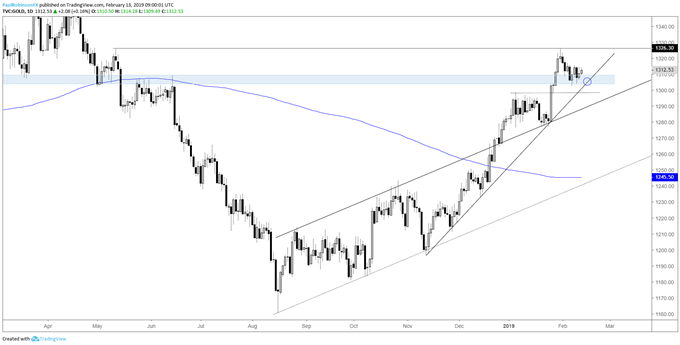

Gold sitting on support, confluence is nearing

Gold continues to sit on support created from a period during the early-part to the middle of last year. Coming up from the south is a trend-line dating back to November with a good number of inflection points. Soon, horizontal and trend-line support will run into one another creating confluence, making for an even more important point in time and price where gold will need hold and get into gear.

The trend remains pointed higher since last year and for now we must respect that – especially since there is support to lean on at this time. Gold was holding well despite the Dollar rising non-stop for over a week, so it was a little surprising to not see it catch a bid yesterday when USD fell. But not entirely surprising as these short-term correlations can be hit or miss, especially in a low-vol environment.

Taking gold for what it is on its own technical merits, as long as support holds then at worst it remains neutral, with upside potential still intact. However, if it doesn’t get gong soon then confluent support might not hold and we’ll see a round of selling towards the upper parallel from August or worse.

Check out the IG Client Sentiment page to see how changes in trader positioning can help signal the next price move in gold and other major markets.

Gold Daily Chart (Support holding so far)

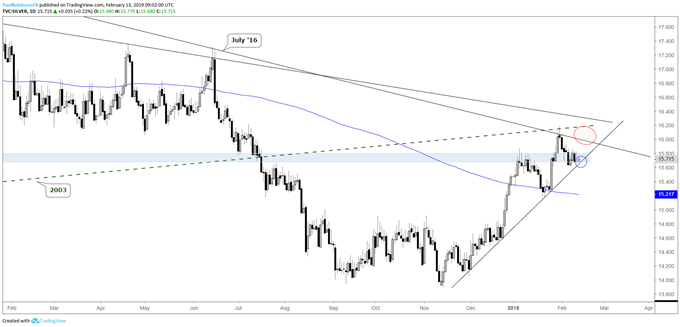

Silver is trickier; at t-line support, but above is t-line resistance

Silver is sitting on t-line support and trading in a rough zone of support going back several years. The trend-line from late last year is more the focus and while price is hanging there has yet to be a push higher.

Even if silver rallies from here it won’t be long before the trend-line from the July 2016 spike-high arrives. The two lines converging puts silver in a tough spot. Gold is positioned better for longs if support levels keep holding, while silver is a more attractive short should we see a round of selling come into precious metals.

Silver Daily Chart (t-line support & resistance)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX