What’s inside:

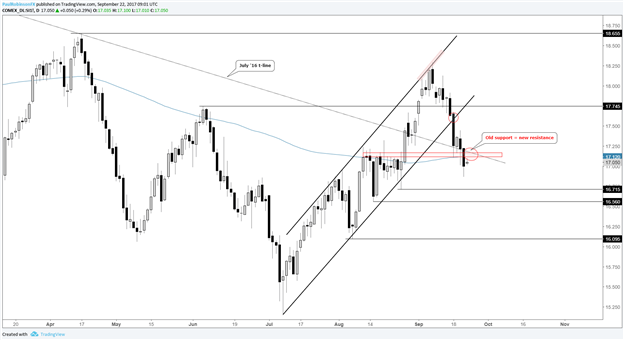

- Silver furthers weakness on channel break below confluence of support

- Gold treading precariously around April/June double-top, August consolidation period

- Key levels and considerations outlined for both precious metals

Check out this newly released trading guide – Building Confidence in Trading

Earlier in the week we made note of the breakdown below key channel support in precious metals, highlighting that it signaled more weakness ahead. We’ll start out by looking at silver and then move onto to its big sibling, gold.

The break below the lower parallel was our initial cue that more selling was on the way, but an immediate point of hesitation came in with regard to shorts as a significant level of support was met immediately upon the breakdown. The area just above 17 has confluence through horizontal price support, the 200-day MA, and a retest of the July 2016 trend-line. It was nearly cracked on Wednesday with the help of a hawkish Fed, but it was yesterday where we got a solid closing print below noted support. (Support now becomes resistance.) This opens up a path towards 16.71, 16.56, and 16.09 in the near-term. The most latter level may be aggressive for short-term positions, but if gold gains momentum below 1290 it may be seen sooner rather than later.

Silver: Daily

Moving on to gold…

Upon the breaking of channel support gold didn’t have any immediate support until the 1296-region where the double-top was formed from April to June. It’s a steadfast area given the rejection and consolidation which took place there in August before eventually being overtaken. Yesterday brought a closing print below 1296, but came right around the closing highs seen during the aforementioned August consolidation period. If gold doesn’t get into gear quick-like, upon a break of 1290 look the recent decline from over 1350 to continue towards 1275, 1267, and with sellers piling in we could see the December trend-line tested closer to 1250. Depending on the timing, the 200-day MA may come into play around the trend-line.

Paul conducts webinars Tuesday-Friday. See the Webinar Calendar for details, and the full line-up of upcoming live events.

Gold: Daily

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.