What’s inside:

- Gold continues to find rejection on attempts to hold above 2011 trend-line, below support now

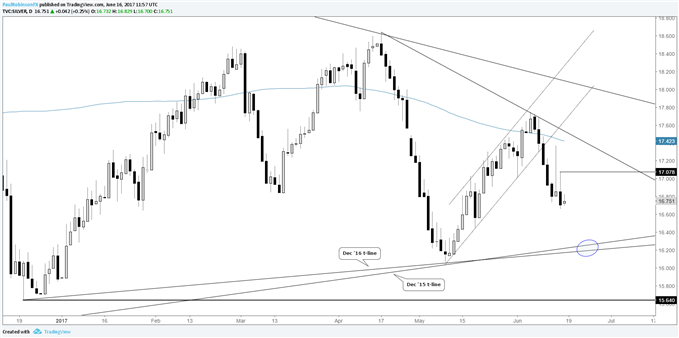

- Silver double reversal days in line with gold

- Looking for silver to drops towards confluence zone of trend-lines in the vicinity of 16.25/20

What’s driving precious metals? Find out in our Trading Guides.

Lately, we’ve been looking to gold for cues as to how to handle silver given the significant play surrounding the all-important 2011 trend-line. Gold crossed above on a daily basis last week, but the nasty weekly reversal bar put the brakes on a major breakout. On the day of the FOMC this week gold was rallying strongly again from support around 1260 until after the announcement, where it then reversed swiftly and put in a strong key reversal bar off a backside retest of the May trend-line. Momentum carried through into yesterday’s session and pushed gold below the 1260 level. This has our attention shifted lower with the 1260s acting as resistance. A close above yesterday’s high at 1267 would put a wrinkle in the near-term bearish outlook. Trend-line support from December is next up as the downside objective, the 200-day, and then March/May t-line. But as long as gold stays below prior support turned resistance, the bias will remain neutral at best.

Gold: Daily

Turning to silver, the reversal on Wednesday was even nastier. Yesterday’s attempt to rally was also rejected. Looking to a downside objective in the near-term, there is a confluence of trend-lines arriving by way of December 2015 and December 2016. These arrive in the vicinity of 16.25/20.

Silver: Daily

Paul conducts webinars every week from Tuesday-Friday. See the Webinar Calendar for details, and the full line-up of all upcoming live events.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.