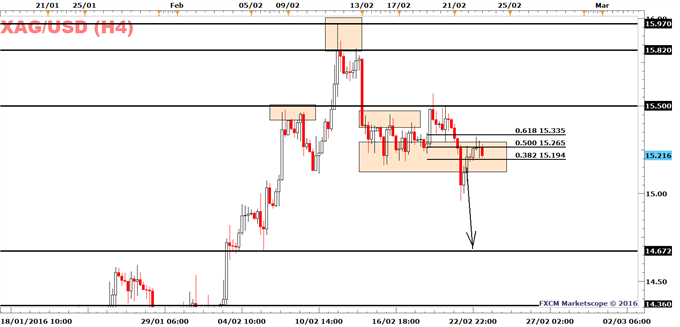

Silver prices have managed to recuperate 61.8% of the drop from last week’s high of $15.57. This will most likely be seen as an opportunity to short-sell silver, as the trend is bearish below Friday’s high of $15.50.

Given that price trades below Friday’s high of $15.50, it may reach yesterday’s low at $14.96, followed by the February 5 low at $14.67.

U.S. interest rates (2 year swap rate) is also suggesting a bearish bias; it projects price at $15. If traders turn as bullish on the Fed as they did in December, silver should be trading near $14 an ounce.

Gold Supports

On the other hand, gold prices and some of the macro data published earlier this week suggests higher silver prices. Given silver’s correlation to Gold, it projects silver should be trading at $15.86.

In the case of the macro data, January PMIs for the U.S., Eurozone, and Japan slid and points towards an economic slowdown at the start of the year. This may translate to higher silver prices on safe haven flows, but for now stock markets are holding up well and risk aversion is contained. See our outlook for the DAX 30 and FTSE 100.

We note that the Markit PMI Manufacturing for the U.S. declined to 51 from 52.4, for the E.U. to 51 from 52, and Japan to 50.2 from 52.

Data on Tap Today

U.S. Consumer confidence, Richmond Fed and Existing Home Sales are on deck today, and may trigger lower silver prices if they beat expectations. On disappointment, silver may rally, but price needs to break $15.50 for the trend to turn bullish.

See the DailyFX Analysts' 1Q forecasts for the Dollar, Euro, Pound, Equities and Gold

Silver Prices | FXCM: XAG/USD

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar