Talking Points

- Silver trades to a new monthly high and may be on its way to trade higher still.

- My simple fair-value-model based on gold prices projects that silver should be trading at $14.75.

- Driver of the current rally appears to be a general uptake in metals.

Losing Money Trading? This Might Be Why

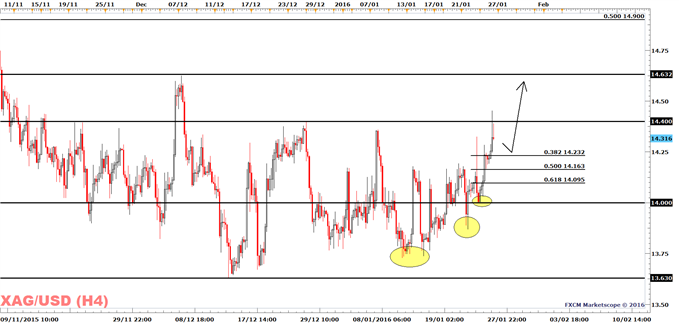

Activity is picking up for silver. This morning price breached its December 28 high of $14.40 and may be on its way to the December 7 high of $14.63. This is also suggested by my simple fair-value-model based on gold prices; it projects silver should be trading at $14.75, which constitutes a 45 cents discount on the current price.

While price still needs to close above $14.40 by the end of today to suggest a breakout has occurred, it is possible to get an early entry, if we believe strongly in the case for higher prices and if we consider that the four-hour-trend is bullish above $14. In this scenario, traders will opt for bullish positions near $14.23 with stops below $14.00. The benefit of such a position is that we get an early entry and stand to make a higher return if proven correct. If we are wrong and price remains capped at $14.40, then traders will take a loss.

Drivers of this Rally: A soft Dollar

It appears that the success of this scenario depends on higher metal prices and a soft Dollar. The six-month correlation to copper prices is at +0.75, while the correlation to EURUSD is at +0.61. The correlation to the S&P 500 is low and this suggests to me that the soft U.S. data hitting markets over the last few weeks is primarily softening the Dollar’s stance and the number of rate hikes expected by the markets. On the other hand, this correlation could just be symptomatic of a genuine interest in accumulating metals and may explain why metal prices are relatively strong, despite a meltdown in Western and Asian stock markets.

Silver Prices | FXCM: XAG/USD

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar