Crude Oil Highlights:

- WTI oil trading on trend-line, 200-day MA support

- Brent crude doing the same, break could point to 60

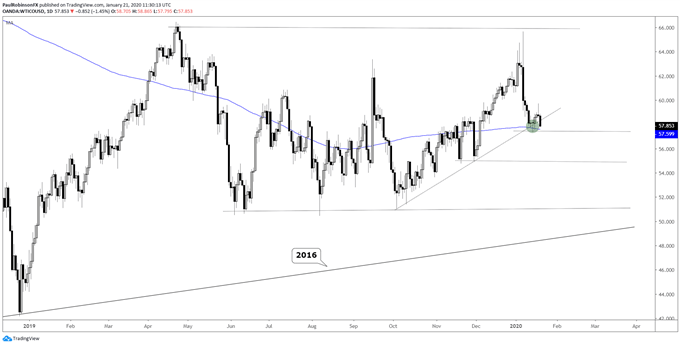

WTI oil trading on trend-line, 200-day MA support

WTI crude oil hasn’t been the easiest place to find opportunities for a while, but from time-to-time over the past six months or so there has been a good level, or set of levels that offer up some solid reference to operate off of. Right now, the level arrives via confluence of support.

The trend-line from the October low is coupling up with the 200-day MA. Last week brought a small bounce off support, but it is quickly back under fire as the week fully kicks off after the U.S. holiday to start the week.

A close below 57.40 should have oil rolling back downhill towards lower levels. Right around 55 are a pair of swing lows created in November, this would be the first area of support eyed on a break below the aforementioned confluent support.

A hold here and rejection of a breakdown could turn the picture more constructive, but it will take a strong push higher to fully do so. The hard break after Iran tensions subsided was damaging and will take some work to reverse if it is to be reversed at all.

WTI Crude Oil Daily Chart (trend-line/200-day support under siege)

WTI Crude Oil Chart by TradingView

Trading Forecasts and Educational Guides for traders of all experience levels can be found on the DailyFX Trading Guides page.

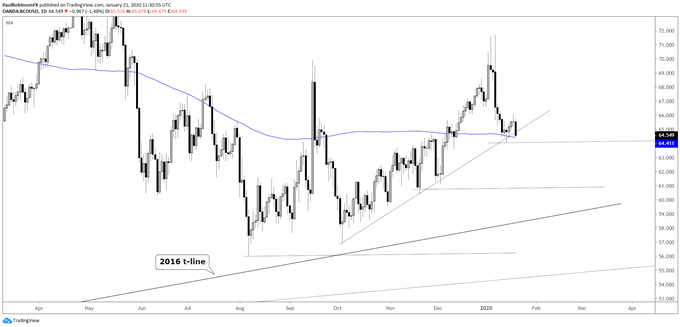

Brent crude doing the same, break could point to 60

Unsurprisingly, Brent is following a similar course as WTI, with 64.03 set as the confirming level in the event of a breakdown. A breakdown, momentum willing, could see to the 2016 trend-line getting targeted. It’s a bit of a distance, currently under 60, but certainly a possibility if trading conditions improve.

Brent Crude Oil Daily Chart (break could have 60 in focus)

Brent Crude Oil Chart by TradingView

***Updates will be provided on the above ideas as well as others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX