Crude Oil Price Forecast Talking Points:

- The ONE Thing: Things are looking up (even more than usual) for crude bulls with Brent trading to $81.86, the highest level since November 2014 with WTI trading near $72. If crude can avoid a bearish chart set-up, then it may soon be off to the races

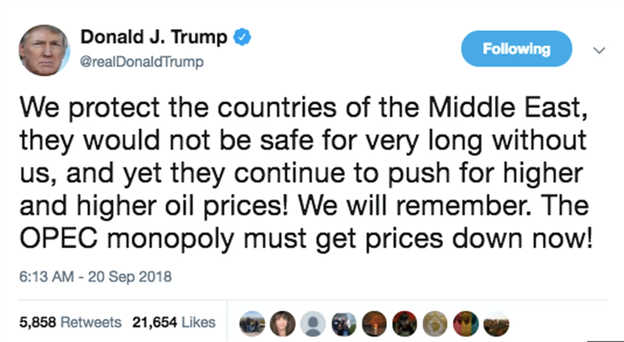

- OPEC’s weekend meeting in Algiers passed with an apparent disregard or outright refusal to heed Trump’s request to an immediate supply boosts. With Trump pushing forward with Iran sanctions, a tighter market may soon result that could put further support under oil.

- Fundamental Focus on Crude Oil: Oil Firms Ahead of Algiers OPEC Meeting That May Set Stage for Q4

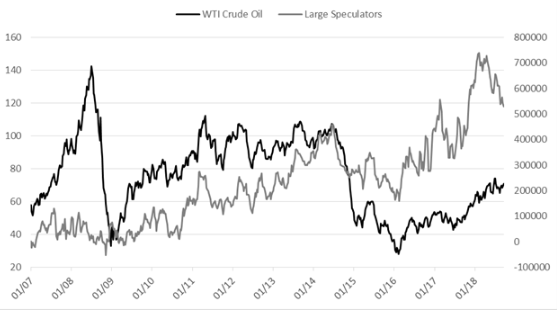

- Not all benchmarks are equal as Brent looks set to widen the spread to WTI as evidenced by the CFTC positioning data that showed Brent longs were increased while WTI positions declined.

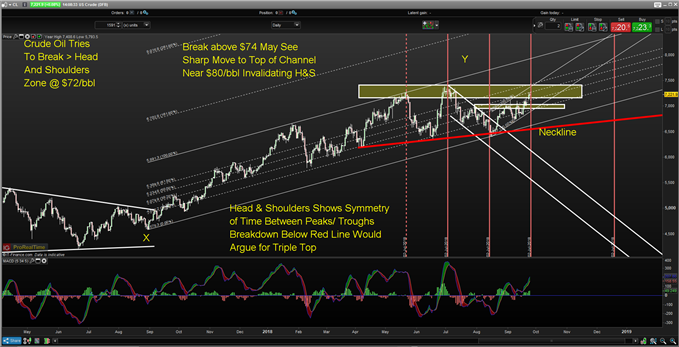

- WTI Crude Oil Technical Analysis Strategy: WTI crude oil may soon test a potential triple top/ head and shoulders reversal pattern. A validation would come from a break below a neckline near $65/bbl. However, a failed bearish pattern (i.e. a bullish breakout) would further support a move toward the trend high at $75.27 or the channel top near $80/bbl.

“I did what I had to do, and saw it through without exemption

I planned each charted course, each careful step along the byway

And more, much more than this, I did it my way”

-Frank Sinatra, My Way

Key Technical Levels for WTI Crude Oil:

- Resistance: $74.08 – July high

- Spot: $72.26/bbl

- Support: $67.81 – September 14 low

I doubt that OPEC listens to Frank Sinatra. However, the lyrics and the song above seem apropos after Trump requested that OPEC “get prices done now!” OPEC has worked hard to stabilize prices with allies like Russia, and manage the depletion of Venezuela and Iranian sanctions that have led to four year highs in crude.

The markets looks to continue bubbling up unless positioning or production aggressively change course, which is not a higher probability play at the present.

Source: Twitter, @realDonaldTrump

That tweet was conveniently sent ahead of the Algiers meeting where OPEC decided not to turn the spigots back on to relieve the tight oil market that is leading to higher prices. Comically, while the Saudi Oil minister says it is ‘not true’ that OPEC is pushing up prices, Iran’s OPEC Representative Hossein Kazempour has said that crude prices “would be cheaper” if Trump would stop tweeting. I don’t think we can count on that.

Option Activity Is Betting on Triple-Digit Crude

After the non-decision by OPEC to ramp up production to make up for Iranian sanctions, the option market went to work. Specifically on calls of outsized gains in crude.

Per Bloomberg, trading volumes on Brent crude calls for $100 and $110 call options (the right, but not the obligation to buy) hit record levels. Traders should also not discount the weakening US Dollar, which would grease the skids for higher crude, and other commodities.

Daily NYMEX WTI –A Head & Shoulders Whose Failure May Signal Upside

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

The chart above shows a key bullish price channel that WTI crude has traded from August 2017 to May with a sharp upside impulse. Since May, the price has moved sideways in a volatile fashion with a move as high as $74.08/bbl, and as low as $63.90/bbl.

This range makes up our potential bearish head and shoulders. Two and a half key events need to take place for a bearish breakdown or follow through to lead to a broader reversal:

- 1: Resistance at $74/bbl holds (price range of extreme day from July)

- 2: Breakdown through neckline at $65/bbl

- 2.5: Further dropdown in WTI bullish positioning (despite Brent moving higher)

Positioning in WTI (Declining Bulls) is Diverging From Brent (Increasing Bulls)

Source: CoT Weekly Update: GBP/USD, AUD/USD & Other Major Markets

What any technical trader should equally be on the lookout for is a failed pattern. Despite a bearish technical pattern at play, the fundamental environment remains bullish and the trend unbroken.

A breakdown would be a shock (though Trump would take credit,) and an invalidation of the bearish head and shoulders would further support the fundamental bullish backdrop.

Unlock of Crude Oil Forecast To See Over the Horizon in the Key Global Energy Market

DFX Trading Resources

Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities, and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we watch.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as trading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Talk markets on twitter @ForexYell