Crude Oil Price Forecast Talking Points:

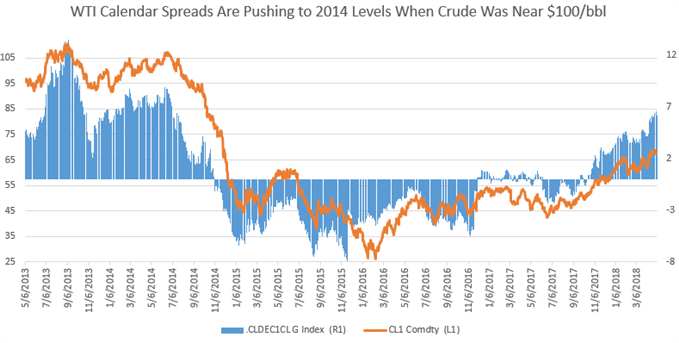

- WTI Crude Oil Technical Analysis Strategy: backwardation continues to breed a buyer’s market. Backwardation is a market condition where a premium is paid to hold the commodity as opposed to buying later despite the costs of insurance and storage. Backwardation tends to signify a demand premium.

- Given the backwardation environment, producers are likely locking in gains as WTI crude sits near $70/bbl. The ability to lock in gains through hedging can lead to selling pressure, but if the trend remains supported (see chart below) bulls should continue to see blue (or green) skies.

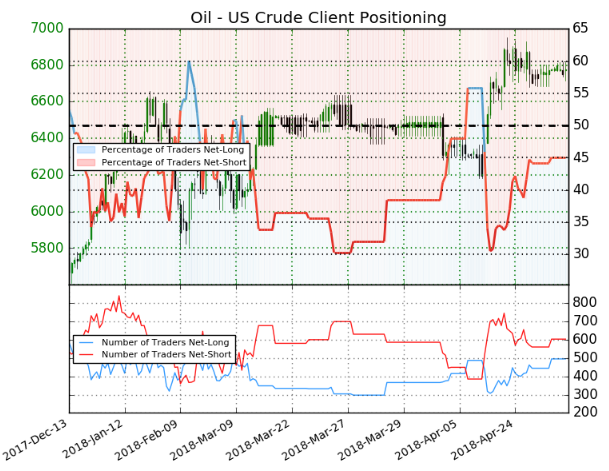

- Trader Sentiment Highlight from IG UK: retail short positions bias favors further advances. Sentiment is utilized as a contrarian technical trading tool, which derives insight from our Traits of Successful Traders research

The initial read from the EIA Crude Oil weekly report appeared concerning as there was a massive build in WTI crude oil inventories. However, after the dust settled, it appears that the build was a bit of an anomaly as it the build was mainly on the West Coast. Additionally, demand for Distillate (refined oil) jumped further as the DoE Distillate inventory recently showed with the lowest levels of inventory since 2014.

24-hours after the report, the price of Crude is roughly mixed, but the culprit to the lack of upside may not be a wave of bearishness (broad bias to sell,) but rather a seized opportunity to lock in gains by producers.

Unlock our Q2 18 forecast to learn what will drive trends for Crude Oil in a volatile Q2

Hedging Is Picking Up, But Future(s) Looking Up

Data source: Bloomberg

The chart above, one that I love to share, shows the cost to deliver crude in December 2019 relative to the cost to deliver crude in December of this year. This is sometimes known as the Dec-Dec Red spread, but the condition is better known as backwardation and the spread has recently widened to ~$6

Technical Analysis – WTI Crude Oil Stays In Bullish Standing > $64.25

Chart Source: Pro Real Time with IG UK Price Feed. Created by Tyler Yell, CMT

WTI crude oil has large support at $65.75-64.25/bbl region. This support zone aligns with a confluence of technical price floors like a multi-month trendline, and the Ichimoku 26-day midpoint.

Where traders should focus on is the pricingin of volatility that remains high. Despite higher variance of price, the backdrop does seem to favor the path of least resistance as pointing higher.

A strong proxy for short-term Oil strength has been the 9-day midpoint, called the Tenkan-sen on Ichimoku. Currently, with WTI, the Tenkan-Sen sits near $68/bbl and the price has traded above the Tenkan-sen since the April 10 breakout, and has since only recently traded lower as of Tuesday. A resumption higher as seen via a close above $68/bbl would argue the trend resumption call.

Short-term momentum traders would do well not to fight a bullish trend where the price trades north of the 9-day midpoint and can place a trailing stop via the 26-day midpoint, also called the conversion line on Ichimoku.

Not familiar with Ichimoku? You’re not alone and in luck. I created a free guide for you here

WTI Crude Oil Insight from IG Client Positioning

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise.

New to FX trading? No worries, we created this guide just for you.

More for You:

Are you looking for longer-term analysis on Crude Oil and other popular markets? Our DailyFX Forecasts for Q2 have a section for each major currency, and we also offer an excess of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our popular and free IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a surplus of helpful trading tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions.

Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell

Join Tyler’s distribution list.