Highlights:

- Crude Oil Technical Strategy: 5-day rebound could travel higher in a hurry

- EIA report revealed gasoline draw and Cushing, OK Inventories fell for 6th straight week

- IGCS Sentiment highlight: sentiment may be showing a bounce higher is underway

You could argue that a supply glut is easier to fix than a demand glut and thankfully, we appear to be facing the former. The concern and focus on when the supply imbalance will be fixed is the reason you and many other traders carefully watch the weekly EIA numbers, which had a slightly disappointing headline, but overall encouraging takeaway message.

In short, Inventories did see a bump higher, but the jump was +0.1% while Cushing, Oklahoma inventories (the largest delivery stock in the US) fell for the sixth straight week. A cause of concern that was raised on Wednesday was a Dallas Fed Survey showing Oil executives expect supply to remain abundant relative to demand until H2 2018.

To see what are top minds in key markets like Oil are forecasting, click here.

There are two developments in the oil market that you should consider that could precede an aggressive move higher as the calendar shifts to H2 2017. First, ICE Futures Europe data shows short positions in Brent are at their highest levels since record keeping began in 2011. While this does not immediately indicate a rally, a further move higher in oil prices would likely encourage a violent short-covering rally though resistance from $48-$50/bbl is expected to hold.

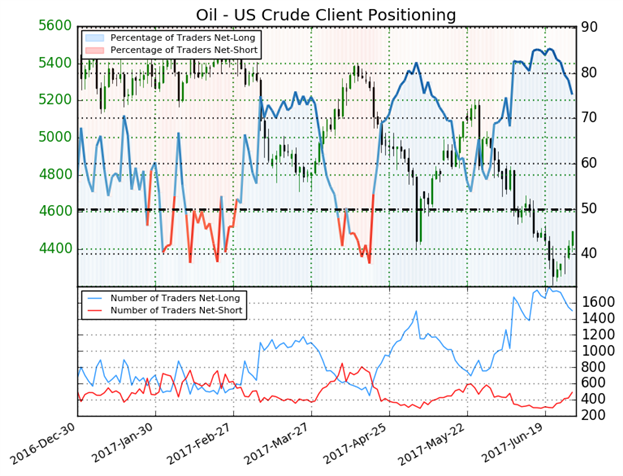

Bears tend to be very impatient traders so that a move higher in the price toward month’s end could bring a strong snap back that could leave short traders wanting to cover and start fresh in July. Second, per IGCS, a definitive rise in short positions and pull back in longs is developing (second chart below). We typically take a contrarian view of crowd sentiment, and recent changes in sentiment warn that the current Oil - US Crude price may soon reverse higher despite the fact traders remain net-long.

The price has recently bounced off rising support and oscillators (not pictured) are rebounding higher from their range lows, which would also favor a technical bounce from being oversold. Another positive technical development is the price overlap from the interim low in May near $44.50/bbl that would indicate choppiness that provides a further argument to a move higher.

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

Crude Oil bounces aggressively off median line support may travel toward $48 on short covering

Chart Created by Tyler Yell, CMT

Crude Oil Sentiment: Rise in Bearish sentiment may be showing a bounce higher is underway

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

Oil - US Crude: Retail trader data shows 75.2% of traders are net-long with the ratio of traders long to short at 3.04 to 1. In fact, traders have remained net-long since Apr 19 when Oil - US Crude traded near 5249.7; price has moved 14.4% lower since then. The percentage of traders net-long is now its lowest since Jun 05 when it traded near 4723.0. The number of traders net-long is 4.2% lower than yesterday and 8.6% lower from last week, while the number of traders net-short is 4.7% higher than yesterday and 36.2% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil - US Crude price trend may soon reverse higher despite the fact traders remain net-long. (Emphasis Mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell