To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

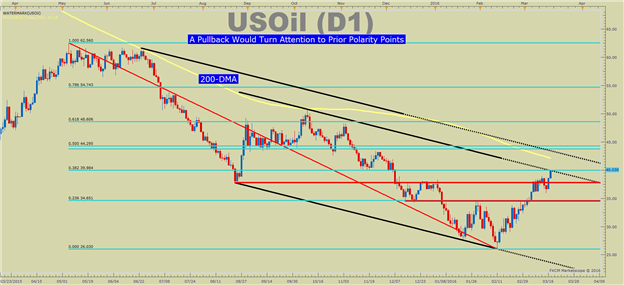

- Crude Oil Technical Strategy: Befriend The Uptrend With Focus on $45/bbl

- Intermarket Analysis Turns Focus of Price Support Of a Weak US Dollar

- Crude Oil Coming Into 38.2% Fibonacci Resistance of 2015-2016 Range at ~40/bbl

Crude Oil is on an absolute tear. We have moved ~50%+ off the February low of $26.06. In doing so, we have taken out a technical tipping point of $34.79 & the August 24 low of $37.73. However, aside from the exciting move higher in Oil, the fundamentals do not appear to have changed aggressively. What has changed is the Intermarket relationship of the US Dollar and Crude Oil. The fall in the US Dollar has lifted the price of Crude Oil, and few are fully sure how the US Dollar will end in 2016 as the Fed has continued to disappoint USD Bulls since March 18, 2015.

When this Bull Run slows down, which will need a sign of US Dollar strength first, the focus should turn to prior resistance turned support. These levels are known as polarity points where resistance turns into support as market and sentiment fully switches. The nearest polarity point is $37.73/bbl, the August 24 low, followed by the December low and late-January high of $34.79. If price holds above there, we could see a breakout just getting started.

WTI Crude Oil Bull Rushes Into the 2016 Highs & Fibonacci Resistance of 2015-2016 Range

Key Oil Price Levels from Here

Beyond the polarity points mentioned above, the main key level just broken through was the 100-dma at 38.68. Now attention will turn the 200-DMA at $42.15 as well the 50% of the 2015 high to 2016 low at $44.30.

Once again, a lot of the direction of Oil will be determined by the trend in the US Dollar. If the US Dollar can continue lower, the price of Oil will have less resistance than in any time over the last year. However, a push higher in the US Dollar and the focus will turn to recent support on US Oil of $37.73/$34.79/bbl. A break below this zone with a higher US Dollar and we could soon see the January 20 & February 11 lows tested.

Contrarian System Warns of Further Price Upside

In addition to the technical and Intermarket focus around the 200-dma and US Dollar direction, we should keep an eye on sentiment. Currently, a move into new highs aligns with our Speculative Sentiment Index or SSI.

Our internal readings of Oil sentiment are showing an SSI reading of -1.1535. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders have moved from net long to now net short provides a contrarian signal that US Oil may continue eventually higher through resistance. If the reading were to turn positive yet again, and the price broke back below $32/30, we could begin looking for a retest of the YTD low of $26.03. Until then, higher looks to be the path of least resistance.

T.Y.

Looking For Short-Term Oil Trading Opportunities? Trade Oil With Low Margin Requirements (non-US Residents only)