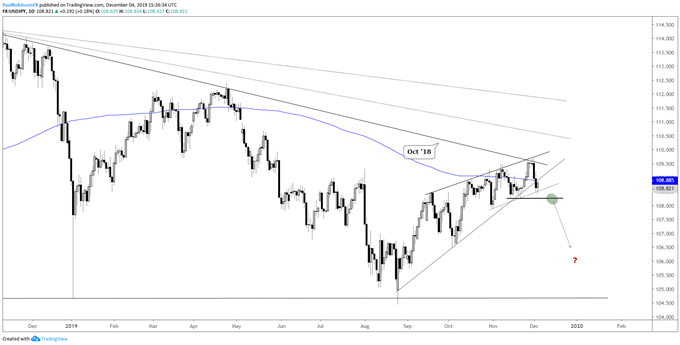

Japanese Yen Highlights:

- USD/JPY trading outside of ascending wedge

- Watch support at 10824, a break could drive momentum

Just a few days ago USD/JPY tagged the trend-line from October 2018, and it was quickly greeted with selling pressure. This shoved the pair lower beneath the underside of an ascending wedge formation developing since the August low.

What is important about this formation is the context in which it is forming, that is it is part of what appears to be a corrective move on a chart that is generally leaning lower. Not trending so much, but leaning, and that tilt can be easily recognized as well by a falling 200-day MA.

The choppy rise, with its overlapping price action, smacks similar of the rally during the first half of the year after the late-2018 plunge. A breakdown from the momentum-lacking rally could set off another trend back towards the 10400s or worse.

At the moment, even though there has been a technical break on the pattern, there is still a series of higher-highs and higher-lows in place. In this low-volatility environment confirmation has become an even more important aspect to successful trading than during times of higher volatility where momentum-moves develop more fluidly.

To begin snapping the bullish price sequence a closing daily bar below the November 14 low at 10824 is needed. This will put into place a lower-low and give shorts a better shot at seeing the trading bias flip in their favor. There could be a bounce shortlythereafter, but as long as it results in a lower-high from Monday’s high, a new downward trend could start to grow legs.

For now, respecting the intermediate-term trend and support, but that respect could dissipate quickly if the ascending wedge holds true to its bearish implications.

Trading Forecasts and Educational Guides for traders of all experience levels can be found on the DailyFX Trading Guides page.

USD/JPY Daily Chart (wedge broke, watch 10824)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX