Japanese Yen Technical Analysis Talking Points:

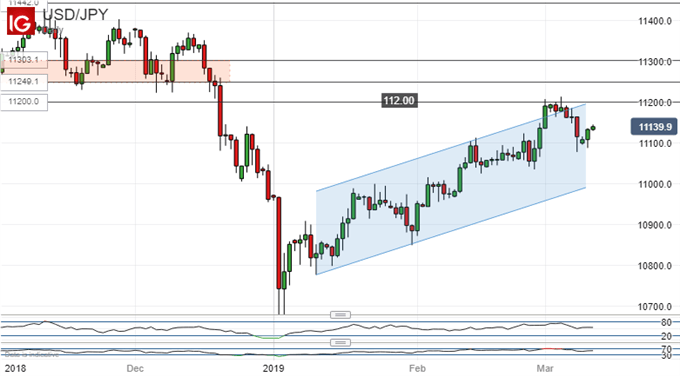

- 112.00 still eludes USD/JPY bulls to the upside

- The overall uptrend remains intact, however, and a break is simply a question of time while this is so

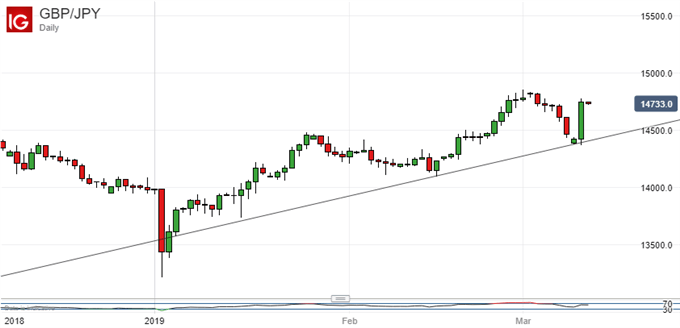

- GBP/JPY’s uptrend is probably a little shakier on fundamental, Brexit-related grounds.

Get live and interactive coverage of all major Japanese economic data at the DailyFX Webinars. We’d love to have you join us.

The Japanese Yen has managed to fend off challenges from Dollar bulls since late February with the psychological 112.00 level remaining out of reach for USD/JPY.

The pair did manage to poke above that point on an intraday basis on February 28 and again on March 5. However daily closes above the line proved elusive and the Dollar has since retreated from the upper reaches of the 111.00 handle.

Dollar bulls are by no means out of the game, but the uncommitted might want to wait and see whether they can manage a higher high over the next week-or-so’s trading. This is possible but hardly certain.

If they can, then a period of consolidation above 112.00 (probably involving at least one weekly close) will likely be needed before the pair can tackle the next upside target. That’s a zone of resistance between 112.49 and 113.03 that bars the way up to the last significant peak- December 13’s 113.70.

USD/JPY remains well within its uptrend channel, so these higher tests remain very much on the cards even if progress may be slow.

To the downside the pair can expect immediate support between 110.42 and 110.9, which is where trade was concentrated between mid-late February. Channel support meanwhile is some way below the market, in the 109.90 region.

Brexit uncertainties continue to plague the UK Pound, but GBP/JPY nevertheless remains above the convincing uptrend which has held daily-chart sway since January 3.

The cross has bounced at that line once again this week but, given those fundamental uncertainties, any sign of a higher high above the recent significant peak of 148.59 may well simply offer a better opportunity to go short, at least over the short-term.

Resources for Traders

Whether you are new to trading or an experienced old hand DailyFX has plenty of resources to help you. There is our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There is also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and best of all they’re free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!