To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

- USD/JPY Technical Strategy: anticipating break and hold above 115, after ST weakness

- Support at Nov. 15 low, ST downward momentum, resistance at 114.73

- Sentiment Highlight: rise in USD/JPY longs cast ST doubt on advancing price

USD/JPY continues to find reasons not to advance. The encouraging development for Bulls is that the weakness in USD/JPY has not brought strong selling of the pair or buying of JPY across the board. The recent cause ‘not to buy’ the cross apparently has been the drop in commodities. After the first week of trading in November, commodities that were hot in October has cooled off. Looking at the forward curves and other fixed income derivative markets, it does not appear there is consensus to favor either risk-off or selling of the USD, which could support USD/JPY going forward.

Bull markets tend to climb a wall of worry, and the chart of USD/JPY shows periods of jubilation to sideways price action. Should the appetite forrisk-return, which seasonal factors favor, the correlation of USD/JPY and risk sentiment could life the pair. A recent battle worth noting is the flattening of the UST curve, which could get a shock depending on end of year US legislating. Another hurdle of worry that has help back USD/JPY has been the pull-back in commodities. The broad Bloomberg Commodity Index peaked within 24-hours as USD/JPY.

Traders would do well to hold a longer-term bullish view above the October low of 111.65. The level of support closer to current price action is the November 15 low, the lowest level since mid-October at 112.48. A hold above these levels would favor the November 14 high at 113.93 followed by a test of the November high of 114.73. An approach toward the latter would favor that long-term forces are pushing toward an extension higher at the YTD high of 118.60, reached on January 3.

Unlock our Q4 forecast to learn what will drive trends for the Japanese Yen and the US Dollar through year-end!

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

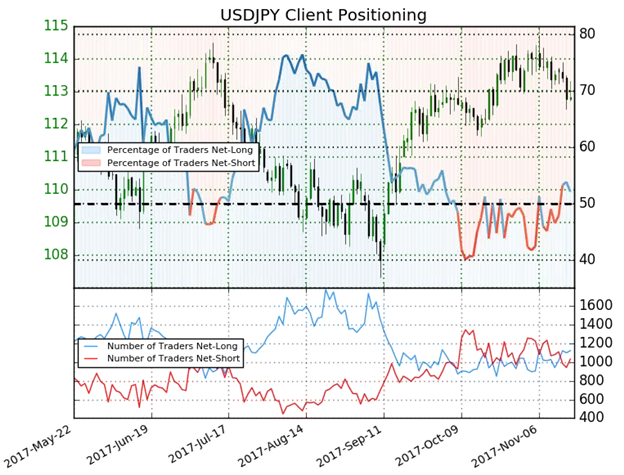

USD/JPY Insight from IG Client Positioning: steady rise in USD/JPY longs cast ST doubt on advancing price

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDJPY: Retail trader data shows 53.2% of traders are net-long with the ratio of traders long to short at 1.13 to 1. The percentage of traders net-long is now its highest since Sep 27 when USDJPY traded near 112.881. The number of traders net-long is 0.9% higher than yesterday and 2.3% higher from last week, while the number of traders net-short is 11.6% lower than yesterday and 23.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bearish contrarian trading bias (emphasis added.)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell