Key Takeaways:

- USD/JPY technical strategy: close below Tenkan-sen (Ichimoku) concerning

- Last week’s closing highs near 112.873 acting as firm closing resistance

- IGCS Highlight: Pickup in long positioning favors resistance on price advance

The rebound in the US Dollar index caught some by surprise and others as a late arrival. The weakness that the US Dollar has seen over 2017 came as the markets began to discount a confident Federal Reserve on the back of a new US administration that was originally thought to bring a fiscal policy that would induce inflation and cause the Fed to hike aggressively.

However, as the year wore one and US economic data weakened, concerns rose that the Fed was getting ahead of themselves. The discounting by the market, which was most clearly seen via Eurodollar futures (different from spot EUR/USD), that the market was pricing in less than one hike over between December 2018 through the end of 2019. This was the extreme point reached in early September when a flurry of positive US data came through, and the Fed in mid-September voiced confidence in hiking again in December and more in 2018.

From mid-September, USD/JPY rallied from 5.5% or ~600 pips from 107.31 to 113.43 over the span of a month. When looking at the chart, you can see an ominous pattern that deserves technical trader’s attention. When overlaying the local trend following indicator, Ichimoku Kinko Hyo (access a guide to explain the indicator here under the advanced tab), you’ll notice a concerning trend. As I’ve highlighted on the chart below,when the price of USD/JPY breaks below the 9-period mid-point, known as the Tenkan-sen, that price tends to drop aggressively or least that’s been the pattern since mid-march.

Should that pattern play out, which is counter to the insight provided from IGCS, we could see another move lower in USD/JPY toward the 108 region. Adding to the drama, and uncertainty of USD/JPY, political risk has seeped into the USD/JPY trade as a snap election called by PM Shinzo Abe to gain a further majority in the lower house. However, an upstart party, the new Party of Hope, led by Tokyo Governor Yuriko Koike could spoil the party (excuse the pun) and add further volatility to the picture.

Insight from the options market has picked up on JPY calls (USD/JPY downside) open interest with expiries set near Oct. 22 (election day). Consensus remains that an Abe coalition sails through, but any upset would likely see those options exercised and a punch lower in all JPY crosses. Since 2012, when Abe’s Liberal Democratic Party came to power, Abe has been synonymous with JPY weakness, and any change in the political landscape could cause sharp moves. The other side of the outcome, a secured Abe victory would likely see USD/JPY break above recent resistance near 112.87/113.21 and open the charts up for a run to recent resistance at 114/15.

Daily USD/JPY Chart: Strong resistance into 112.87/113.26 Zone

Chart Created by Tyler Yell, CMT

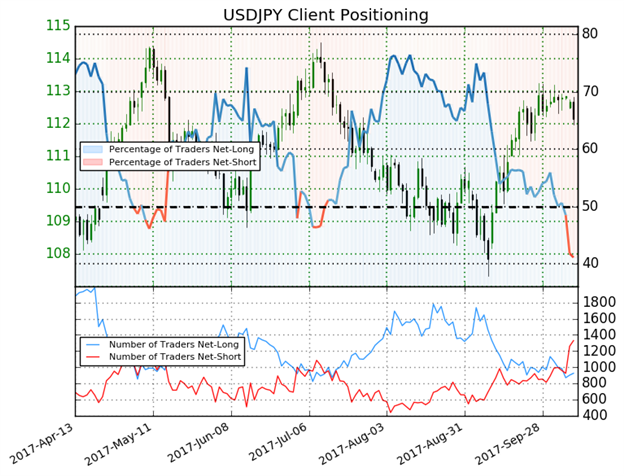

USD/JPY Insight from IG Client Positioning: Pickup in long positioning favors resistance on price advance

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDJPY: Retail trader data shows 41.1% of traders are net-long with the ratio of traders short to long at 1.43 to 1. The number of traders net-long is 2.8% lower than yesterday and 14.3% lower from last week, while the number of traders net-short is 16.4% higher than yesterday and 33.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDJPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bullish contrarian trading bias(emphasis added.)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell