Talking Points:

- USD/JPY technical strategy: anticipating breakout above trend resistance, 61.8% fibo

- US data weakness continues on Friday with CPI & Retail Sales below est.

- 100% extension of Andrew’s Pitchfork set as key trend resistance

USD/JPY on its own has made USD Bulls look good. Currently, the JPY sits on a relative basis as the weakest G8 currency when compared on a 240-minute chart with a 200-MA filter. JPY is not the only weak currency on a relative basis using the same measuring stick. AUD, NZD, & CAD have been weak as well as commodities have been surprisingly soft in Q2.

However, USD/JPY has remained elevated as well as JPY against stronger currencies like EUR & GBP continues to underperform. One reason for the underperformance for JPY can be seen in the low volatility that is shown via the VIX, which closed below 10 for the first time since 1993 and is positively correlated with JPY. Therefore, low implied volatility favors an environment where there is little demand for JPY, which looks to be playing out.

Another theme developing besides the low volatility favoring a weak JPY is the weakness in US economic data. On Friday, US Retail Sales & CPI were below estimates, and the Citi Economic Surprise Index for USD fell to its lowest level in a year. The Citi Economic Surprise Index is Citi’s way of measuring how actual economic performance comes out in relation to economists best estimates, and consistently, we’ve seen US data underperforming economists expectations.

The underperformance in the US has been one reason why USD/JPY has pulled back this week. However, when combining the sentiment picture below with the persistently weak JPY, we may continue to see upside in USD/JPY even if JPY weakness is best played against another base currency.

On the chart below, I would watch for the price of USD/JPY staying above the 240-minute Ichimoku cloud to validate a Bullish environment. The trigger that the upside is set to resume would be on a dual break and daily close above the 61.8% retracement level of the 2017 price range and the 100% extension (maroon downward sloping line) of Andrew’s Pitchfork. Despite the weak fundamental data in the US, such technical developments would likely favor further price appreciation in USD/JPY. A break and close of the price below the Ichimoku Cloud would argue for a deeper setback.

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss market developments.

Chart Created by Tyler Yell, CMT

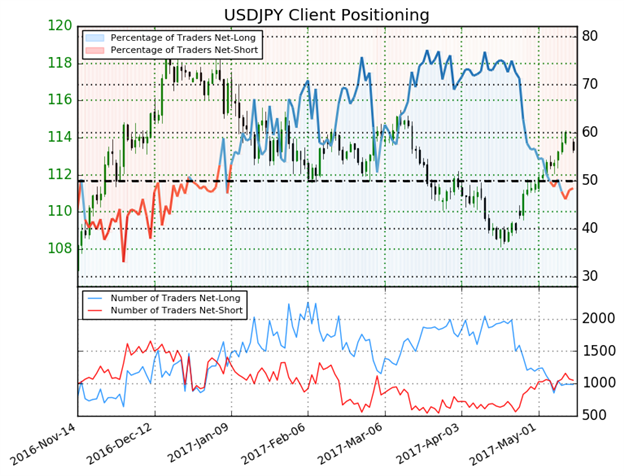

USD/JPY IG Trader Sentiment: Yen Mixed as Traders Go Short

What do retail traders’ buy/sell decisions hint about the JPY trend? Find out here !

USDJPY: Retail trader data shows 48.4% of traders are net-long with the ratio of traders short to long at 1.07 to 1. The number of traders net-long is 3.2% lower than yesterday and 4.3% lower from last week, while the number of traders net-short is 6.1% lower than yesterday and 0.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDJPY prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USDJPY trading bias. (Emphasis Mine)

The takeaway from me for IG Client Sentiment on USD/JPY is that longs are getting less aggressive week-over-week. In taking a contrarian view, this opens up the likelihood of further upside. A break above the 61.8% retracement at 114.61 with this sentiment picture holding could precede a breakout.

---

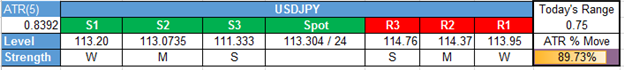

Shorter-Term USD/JPY Technical Levels: Friday, May 12, 2017

For those interested in shorter-term levels of focus than the ones above, these levels signal important potential pivot levels over the next 48-hours.

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell