Talking Points:

- USD/JPY Technical Strategy: Awaiting Breakout, Preference Lower

- Positioning Favors Weakness Shorter-Term as Prices Consolidate Between 121.90 & 118.50

- Long-Term Trend Keeps Eyes on Upside Break of 122 And Trend Continuation

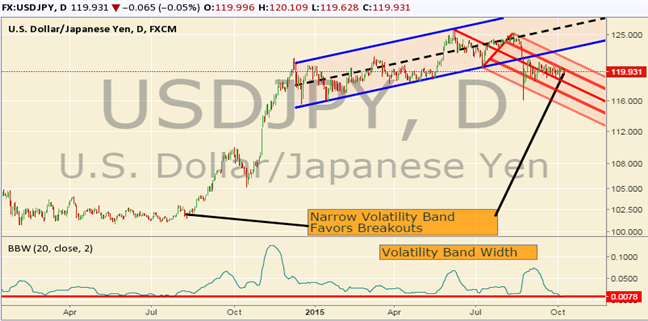

The narrowest move in USDJPY in over three decades is upon us according to Volatility Bands on the daily chart. The narrow bands cause us to stay alert for the next big breakout. Typical narrowing of volatility bands like the oscillator shows below the featured chart tends to precede major moves. The red channel tool (Andrew’s Pitchfork) would favor a downside break, but a close above resistance at 121.85/122.00 would invalidate that view. Today’s FOMC minutes showed markets that Fed officials put off the September rate hike on increasing risks to growth and inflation hitting targets.

USDJPY currently sits fixed between 121.85 and 118.50 after the August 24th fallout. The price pattern currently favors a wedge where traders look for continuation in the direction of the move prior to the wedge or lower, but the long-term trend keeps the preference on an upside break. Given the Volatility Band narrowing, a breakdown below the September 4th low and Aug. 24th close of 118.40/58, opens the door for a challenge of 116.082.

The USDollar has pulled away once again from the March 13th range. A break below the September 18th low on the USDollar aligned with an unwinding of the USDJPY caution gives preference for a break below support mentioned higher. Shorter-term trading on USDJPY is favored ahead of the October 30th BoJ meeting. Many market participants anticipate further expansion of QQE from the BoJ, which could send this pair higher again in alignment with its multi-year uptrend. Unless a bigger market

Add these technical levels directly to your charts with our Support/Resistance Wizard app!