Talking Points:

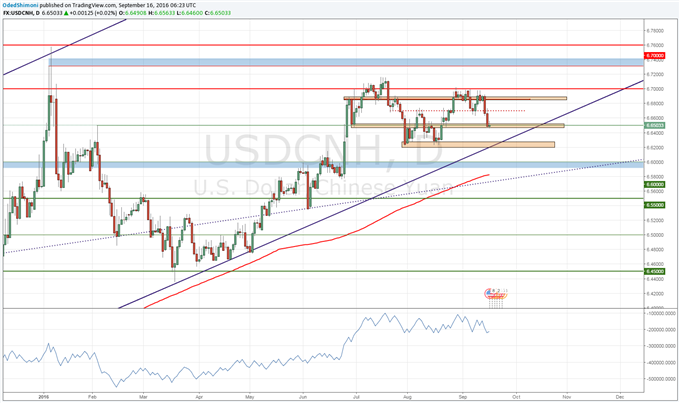

- USD/CNH failed to hold above 6.6860, broke interim support at 6.6700

- The pair currently trading around potential support at 6.6500

- 6.7 remains the big level to watch on strength

If you’re looking for trading ideas, check out our Trading Guides Here

The US Dollar is trading around 6.6500 versus the Chinese Yuan in offshore trade, after the pair lost ground following another failed attempt at the 6.7 handle.

The pair found support above the last short term swing high (~6.6700), but failed to clear 6.7 before diving lower.

The pair might find support at 6.6500, while a break below seems likely to shift focus to the last swing low at 6.6224, which also coincides with a long term rising trend line.

In the current range trading conditions, potential resistance appears clear at 6.6700, 6.6860 and the big 6.7 handle.

USD/CNH Daily Chart: September 16, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni