To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

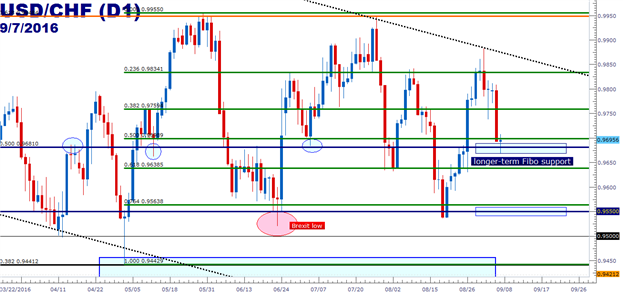

- USD/CHF Technical Strategy: The range continues; aggressive reversal after hitting resistance last week.

- An analyst pick was issued shortly after last week’s article, and the first target has been hit, stop moved to break-even.

- SSI - If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

In our last article, we looked at the sharp and aggressive short-term up-trend in Swissy; but drew attention to the longer-term range in the pair. Given that price action had run into a well-tested zone of resistance, this presented a scenario in which traders could use the ramp-higher on the short-term move in order to sell resistance of the longer-term range; using the basis of the resistance level at .9834 to substantiate the approach.

As U.S. rate expectations have shuffled lower in the days after that article was published, USD/CHF has slammed down to deeper support levels; snuffing out that prior short-term up-trend with price action driving lower to the longer-term Fibonacci level at .9681. This level is a key area for price action, as this is the 50% retracement of the 2008 high to the 2011 low in the pair; and perhaps more importantly, has functioned as support and/or resistance numerous times over the past five years. On the chart below, we look at this reversal down to the longer-term Fibonacci support level.

Created with Marketscope/Trading Station II; prepared by James Stanley

Moving forward, traders would likely want to wait for price action to move towards support or resistance of the 6-month range before looking to trigger additional positions. On the support side of the pair, this would be looking for price action sub-.9600, and perhaps more attractive would be support showing up between the longer-term swing of .9441-.9550; at which point resistance targets at .9834 and .9948 could become attractive again. On the top-side of the pair, the same zone of resistance we looked at last week (and the same targets for bullish plays off of support) from .9834-.9948 could be attractive moving forward.

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX