To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

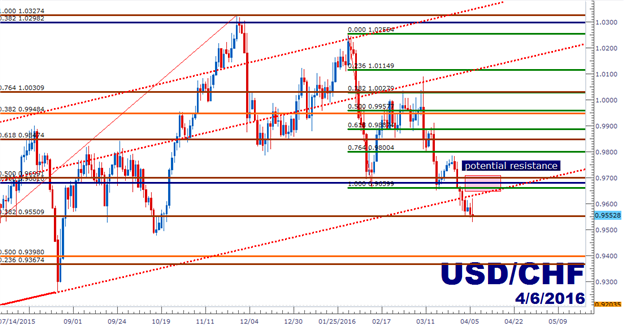

- USD/CHF Technical Strategy: Short, targets remain at .9500 and .9441. Conditional short identified.

- If you’re looking for trade ideas, check out our Trading Guides; they’re free.

- SSI remains stretched in Swissy by a tune of +3.18-to-1 and this is bearish. Click here to learn more about SSI.

In our last article we looked at another short setup in USD/CHF off of the .9948 Fib level, which is the 38.2% retracement of the secondary major move in the pair, taking the 2010 high to the 2011 low (shown in orange on the below chart). And it took a little while to develop, but since we’ve seen massive USD weakness develop, finally breaking below the upward sloping channel that had started in May of 2015.

The primary obstacle in the setup at current is yet another Fib level that’s continuing to prove stubborn to bears. This is the 38.2% retracement of the most recent major move (shown in maroon below, taking the May 2015 low to the November 2015 high). This support has quelled the declines in Swissy on 3 of the last 4 trading days, and this is enough evidence of a potential short-term low to urge caution to short sellers.

More attractive for short-side setups would be looking to the prior support zone for subsequent selling positions. Should price action find resistance in the zone between .9660 (the February 2016 low) to .9700 (the 50% Fib of the most recent major move), traders could look at short-side entries in the direction of the predominant trend (lower). Traders can use price action to trigger the position by looking for an extended top-side wick in this zone, indicating that sellers may be reacting. This could open the door for profit targets at this current level of support at .9550, followed by .9500 (major psychological level), and then .9400, which is just 2 pips above the 50% retracement of the secondary major move in the pair.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX