To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Talking Points:

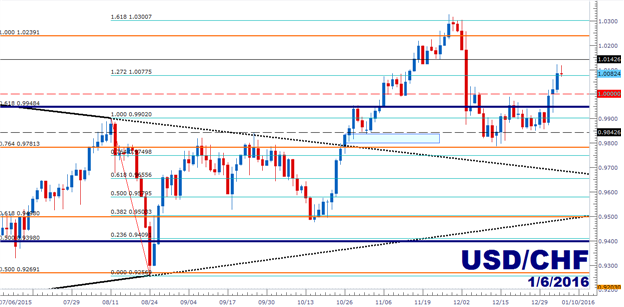

- USD/CHF Technical Strategy: Long, two more targets met, two targets remain.

- Swissy has continued to trudge higher in its post-FOMC continuation move.

- To time moves in USD/CHF, trader sentiment can be really helpful. We offer this in a real-time format here for free.

In our last article, we looked at the continued up-trend in USD/CHF after the FOMC rate hike began to bring strength back into the US Dollar. Previous to that, we had looked at Swissy as one of the more attractive ways of getting long USD around ahead of the Fed meeting in which much of the world was expecting a hike. At the time, price action had nuzzled up to a long-term Fibonacci level at .9781, which is the 76.4% of the January 2015 high/low in the pair.

The initial target at .9948 was promptly hit after that FOMC meeting, and over the past four trading days we’ve seen another two targets get taken out at parity and then 1.0077, which is the 27.2% extension of the most recent major move, with two targets remaining at 1.0239 (January high) and 1.0300 (1.618 extension of that most recent major move) and the most recent swing-high in the pair.

Moving forward, getting long USD/CHF is going to be a matter of how aggressively you want to push the move. The past four days of strength have blown through numerous resistance levels, and prices are still looking expensive on a relative basis. On top of that, today’s candlestick is putting in a Doji, which when combined with the previous day’s strength and near-identical apex of the wicks from these two days, and we may be looking at a swing-lower in the days ahead.

If a trader really wants to push the move, they can posit that near-term support may be building at this 1.0077 Fibonacci extension. This could allow for a relatively tight stop that can be justified with a target at the previous swing-low of 1.0142.

But perhaps a more prudent approach is waiting to see if this two-day candlestick set is going to move lower. If so, that level of parity could be a phenomenal area to look for forward-moving support. If parity comes into play during the remainder of the week, the trader can wait for an extended bottom-side wick on the hourly or four-hour chart before triggering, with the presumption that the short-term reversal that exposes that bottom-side wick may turn into something larger.

For this approach, the same top-side profit targets would apply with levels at 1.0077, 1.0142, 1.0239, and then 1.0300.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX