USD/CAD Technical Outlook

- USD/CAD trend has been persistent but yesterday put in a pause

- Will the pause have USD/CAD emerging or setting up for more selling?

USD/CAD Technical Outlook: Sell-off Pausing or Reversing?

USD/CAD has been very weak the past month, with very little reprieve since the selling began. Nothing trends straight up or down without a few corrections and pauses along the way. Yesterday’s reversal wasn’t uber powerful, but enough to give pause to the current trend.

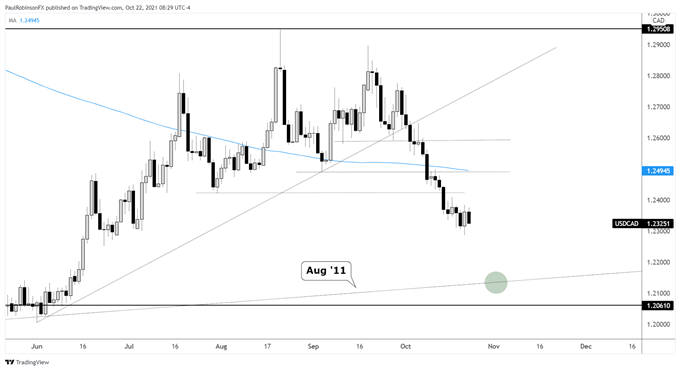

It may turn into a consolidation phase that ends up leading USD/CAD lower, that is yet to be seen. Or it could signal that a broader rebound is in play. Either way, it doesn’t appear we have hit a meaningful low yet. If we see bounce develop, 12422 is the first level of resistance to watch.

This is followed up by the 200-day moving average that is in confluence with the September low at 12493. It seems unlikely a bounce to that point will develop given the general strength of the downtrend, but it can’t be ruled out.

Looking lower, should we see only a temporary pause or less (selling commences again immediately), the next major threshold to watch is a trend-line that was born in August 2011. It passes under the late May low. It could offer a meaningful low should it get met, that is currently down around 12130-ish.

From a tactical standpoint, existing shorts may want to tighten up stops with a trailing stop strategy, while would-be shorts may be best served by being patient until a continuation pattern or failing countertrend rally unfolds.

Longs don’t hold much appeal at this time, but countertrend traders could use yesterday’s low at 12288 as a point of reference for stops.

USD/CAD Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX