Canadian Dollar Technical Price Outlook: Near-term Trade Levels

- Canadian Dollar updated technical trade levels – Daily & Intraday Charts

- USD/CAD plunges through monthly range / key support- 2021 low in view

- Key Support into 1.2358 – resistance / near-term bearish invalidation 1.2485

The Canadian Dollar has rallied more than 1.24% against the US Dollar this month with a break below the April opening-range taking USD/CAD back towards the yearly low. While the breakdown does keep the broader focus lower, the decline may be vulnerable in the days ahead as price approaches support just lower with the FOMC interest rate decision on tap tomorrow. These are the updated targets and invalidation levels that matter on the USD/CAD price charts. Review my latest Strategy Webinar for an in-depth breakdown of this Loonie technical setup and more.

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Technical Outlook: In my last Canadian Dollar Price Outlook we noted to be, “on breakout watch with the broader recovery at risk below 1.26…” Loonie marked a massive outside-day reversal on the heels of the Bank of Canada interest rate decision with USD/CAD covering the entire monthly range in that single session. A break below the April opening-range / key support yesterday at 1.2468/85 fueled a sell-off of nearly 0.7% with the decline now the yearly lows.

Initial support rests at the March 2020 trendline (blue) backed by the yearly lows / 88.6% Fibonacci retracement of the 2017 advance at 1.2358/65- a break / close below this threshold would be needed to keep the immediate decline viable towards the 2018 low-day close at 1.2312 and the 2018 low at 1.2247.

Canadian Dollar Price Chart – USD/CAD 240min

Notes: A closer look at Loonie price action shows USD/CAD breaking below confluence support into the weekly open at 1.2473-85- a region defined by the 61.8% retracement of the March rally, the objective year-to-date low-day close, and the 100% extension of the late-March decline. This zone also defines this week’s opening-range highs and as such, will serve as our near-term bearish invalidation level- a breach / close above this resistance threshold would threaten a larger reversal / recovery towards the 1.26-handle once again.

Bottom line: USD/CAD has broken below confluence support / the monthly opening-range lows and keeps the focus lower heading into he close of the month. That said, the decline has already extended more than 2% off the monthly highs in just four-days with the price already approaching initial support objectives. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards the yearly lows – recoveries should be limited to 1.2485 IF price is indeed heading lower with a close below 1.2358 needed to keep the immediate short-bias viable. Review my latest Canadian Dollar Weekly Price Outlook for a closer look at the longer-term USD/CAD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Canadian Dollar Trader Sentiment – USD/CAD Price Chart

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +3.37 (77.14% of traders are long) – typically bearish reading

- Long positions are21.49% higher than yesterday and 32.24% higher from last week

- Short positions are 16.89% lower than yesterday and 28.07% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 20% | -3% | 5% |

| Weekly | 64% | -12% | 7% |

---

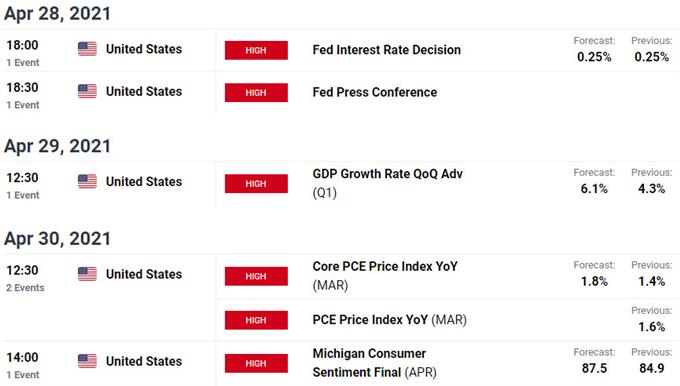

Key US / Canada Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Technical Setups

- Gold Price Outlook: Gold Breakout Stalls at Trend Resistance

- WTI Crude Oil Price Outlook: Breakout Eyes Resistance- Bulls at Risk

- Australian Dollar Outlook: AUD/USD Rips into April- Breakout Levels

- Sterling Outlook: GBP/USD April Range Set on Support- Cable Levels

- Mexican Peso Outlook: USD/MXN Plummets into Support– Bears Face NFP

- US Dollar Outlook: DXY Breakout Vulnerable into April Open / NFP

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex