Canadian Dollar Forecast Overview:

- The Canadian Dollar may finally be waking up out of its slumber, having traded sideways versus other major currencies for several weeks.

- Pairs like CAD/JPY and USD/CAD have moved beyond recent consolidation bands, suggesting that directional trading favorable to the Canadian Dollar may ensue.

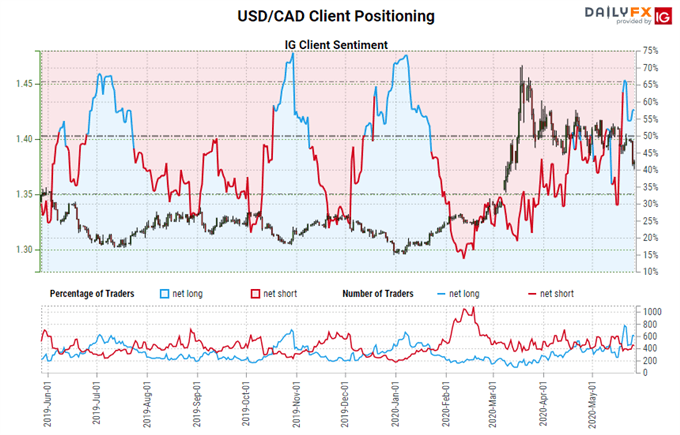

- According to the IG Client Sentiment Index, USD/CAD rates have a mixed trading bias in the near-term.

Canadian Dollar Catches a Bid

The Canadian Dollar’s stability over the past two months, following the dramatic plunge in energy markets amid the fallout from the coronavirus pandemic, may finally be giving way to a more directional, bullish move. The sustained rebound in WTI crude oil prices, the North American benchmark, as well as Canada’s Western Canadian Select oil prices, has allowed the energy-sensitive the Loonie an opportunity to further retrace lost ground from its 2020 highs.

BOC Interest Rate Cut Expectations Subside

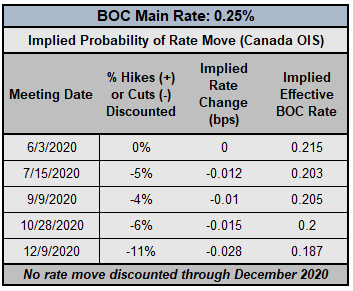

Traders have reconsidered their stance on the Bank of Canada. Less than a week ago, there was a 55% chance of a 25-bps interest rate cut in December 2020, according to Canada overnight index swaps. But the concurrent moves in global equity and energy markets has laid a more supportive foundation from which the Canadian Dollar can work, leading traders to cut their bets on a more aggressive BOC. To this end, there is only an 11% chance of a 25-bps rate cut through December 2020, a sharp decline from last week.

Bank of Canada Interest Rate Expectations (May 27, 2020) (Table 1)

And so, the Bank of Canada’s efforts along the interest rate front may be complete after all. While the BOC has cut the main interest rate to an all-time low of 0.25%, there have been some signals to the market that it may not be done yet (see: April BOC meeting). If the BOC does anything else, it may not be to cut interest rates to zero – or to negative territory.

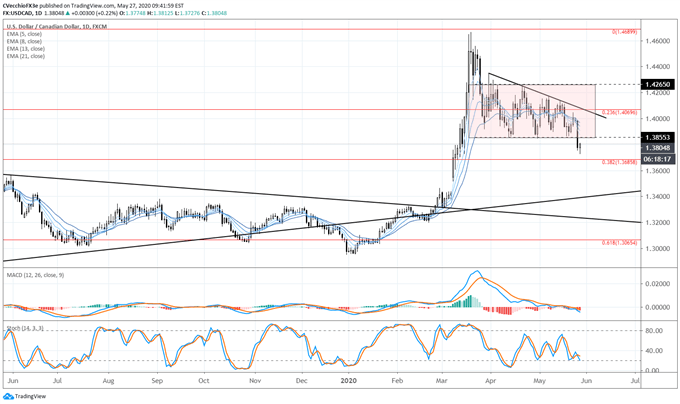

USD/CAD Rate Technical Analysis: Daily Chart (May 2019 to May 2020) (Chart 1)

In the last USD/CAD rate forecast, it was noted that “USD/CAD rates have been rangebound between 1.3855 and 1.4265 since the end of March, and until this range breaks, there’s little reason to believe a significant move is nearby.” A break to the downside transpired on May 26. Given the range (410-pips), the measured move calls for a downside target of 1.3445.

To this end, USD/CAD rates are now below their daily 5, 8-, 13-, and 21-EMA envelope – which happens to be in bearish sequential order. Daily MACD’s decline into bearish territory below the signal line appears to be accelerating, while Slow Stochastics have started to drop back into oversold territory.

Should USD/CAD rates return back through range support at 1.3855, it would create the potential for a false breakout and thus a return to the other side of the consolidation, resistance at 1.4265.

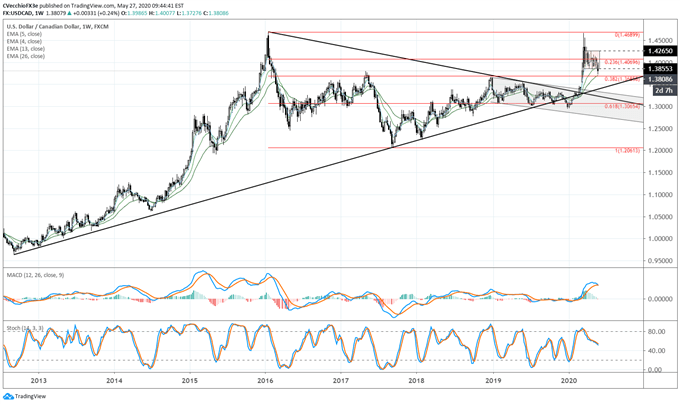

USD/CAD Rate Technical Analysis: Weekly Chart (December 2016 to May 2020) (Chart 2)

It still holds that, “in the event of a short-term USD/CAD rate reversal to the downside, the longer-term bias may still be higher for the pair. On the weekly timeframe, USD/CAD rates remain well-above their weekly 4-, 13-, and 26-EMA envelope. Although Slow Stochastics are pulling back from overbought territory, weekly MACD continues to trend higher in bullish territory.” This commentary from April 7 remains valid.

IG Client Sentiment Index: USD/CAD Rate Forecast (May 27, 2020) (Chart 3)

USD/CAD: Retail trader data shows 47.01% of traders are net-long with the ratio of traders short to long at 1.13 to 1. The number of traders net-long is 8.89% higher than yesterday and 14.04% lower from last week, while the number of traders net-short is 36.48% higher than yesterday and 44.08% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

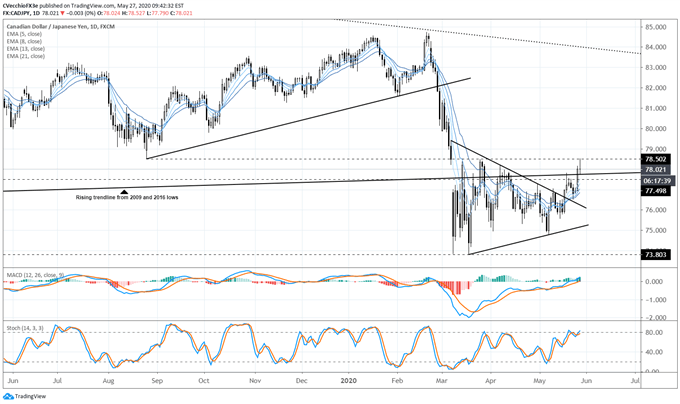

CAD/JPY Rate Technical Analysis: Daily Chart (May 2019 to May 2020) (Chart 4)

CAD/JPY rates have climbed back through the rising trendline from the 2009 and 2016 lows, giving life to the idea that the symmetrical triangle, having formed since early-March, has yielded a topside breakout effort. But the move has occurred prior to CAD/JPY rates retaking the 2019 low and symmetrical triangle swing highs near 78.50.

For the past several weeks, and once more in the prior CAD/JPY rate forecast update, it was noted that “CAD/JPY rates have not been able to climb back above the rising trendline from the 2009 and 2016 lows – support for the past decade. Failure to re-establish itself through the August 2019 low at 78.50 is a necessary precursor to any trades taken from the long side, in this strategist’s opinion.” CAD/JPY rates hit a high of 78.50 earlier today – we could be on the cusp of clearing out the first hurdle to validating the idea that the bottom is in for CAD/JPY.

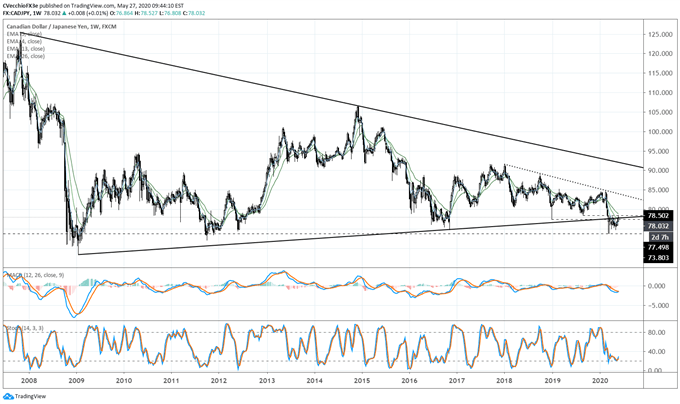

CAD/JPY Rate Technical Analysis: Weekly Chart (June 2007 to May 2020) (Chart 5)

Bigger picture for CAD/JPY rates: there is much ground to be made up to get back to the 2020 highs established in late-February. But clearing out 78.50 will also see CAD/JPY rates rise above the descending trendline from the October 2018 and July 2019 lows, offering another piece of evidence that a near-term low may have been established.

It’s still too early, however, to say that the worst is over yet for CAD/JPY: without clearing out 78.50, the loss of the uptrend from the 2009 and 2016 lows could prove long-term detrimental for CAD/JPY rates.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist