USD/CAD Technical Highlights:

- USD/CAD pullback may have finished

- A sustained push out of channel to confirm

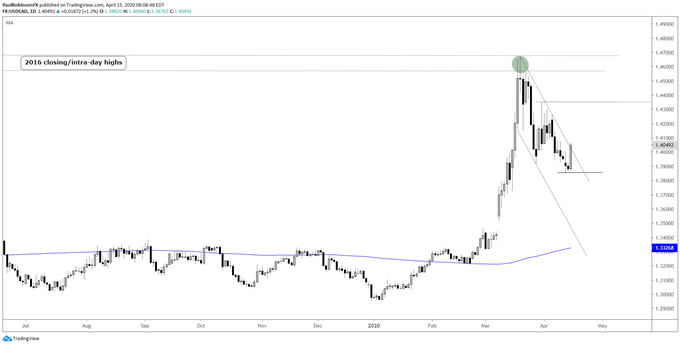

Just the other day USD/CAD broke the March 27 low at 13920, but it was weak in doing so with little selling pressured garnered. This has given way to a strong push higher ahead of the BoC today. The push is getting price to inch above the upper parallel of the channel that has formed off the March high. It could be an important event as the period of recent is viewed as corrective in a larger cycle higher.

A sustained break above the upper parallel could lead to a strong push higher, but even if it is lacking in strong momentum, a new leg higher may be developing nonetheless. A breakdown below 13855 will be needed to undercut the turn higher.

If the break indeed holds, though, the next level of resistance doesn’t arrive until a zone created during the first few days of April; 14261-14349 is the hurdle. Beyond that point we will then have to focus on the 2016 levels over 14600 that put the recent pullback into motion.

Today’s BoC meeting may have a meaningful impact on this outlook. But even as such, as it stands from a technical standpoint as long as the breakout above the upper parallel maintains and the lower at 13855 holds, then USD/CAD is postured for the upside.

USD/CAD Daily Chart (trying to turn back towards 2016 high)

USD/CAD 4-hr Chart (working on channel breakout)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX