Canadian Dollar Technical Price Outlook: USD/CAD Weekly Trade Levels

- Canadian Dollar updated technical trade levels - Weekly Chart

- USD/CAD breakout accelerates as Coronavirus Pandemic / Oil Price War fears grow

- Loonie losses take USD/CAD into long-term uptrend resistance

The Canadian Dollar is off more than 3% against the US Dollar with the USD/CAD breakout accelerating this week on growing concerns over the Coronavirus global pandemic. Simultaneously, rising Saudi-Russia tensions over the brewing oil price war has slammed crude prices and further fueled Loonie losses. The move takes USD/CAD into multi-year trendline resistance and leaves the immediate long-bias vulnerable into this slope. These are the updated targets and invalidation levels that matter on the USD/CAD weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie trade setup and more.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Notes: In my last Canadian Dollar Weekly Price Outlook we noted that USD/CAD was trading, “within the confines of a broad multi-year consolidation pattern with the recent rally turning just ahead of trend resistance.” A quick defense of the 1.32-handle was followed by a breakout in late-February with a break-away gap into the open of this week fueling a rally through key confluence resistance at the 2017 high-week close / 2018 & 2019 highs / 61.8% retracement at 1.3647/85. The advance is now approaching a sliding parallel (red) of the dominant slope we’ve been tracking off the 2016 / 2017 pitchfork.

Initial weekly support now back at 1.3647 with a break / close below the May high-week close at 1.3515 needed to suggest this was just a false breakout with broader bullish invalidation at 1.3370. A topside breach from here exposes subsequent resistance objectives at the 61.8% ext at 1.3949 backed by the median-line and the 2016 high-week reversal close / 78.6% retracement at 1.4115/27- both levels of interest for possible topside exhaustion IF reached.

Bottom line: The USD/CAD breakout is now approaching multi-year uptrend resistance and leaves the immediate long-bias vulnerable into this parallel. From trading standpoint, a good region to reduce long-exposure / raise protective stops- be on the lookout for possible topside exhaustion near-term while below this slope- watch the weekly close with respect to today’s high with a close above needed to keep the long-bias viable into next week. Ultimately, a pullback in price may offer more favorable long-entries closer to uptrend support. Review my latest Canadian Dollar Price Outlook for a closer look at the near-term USD/CAD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

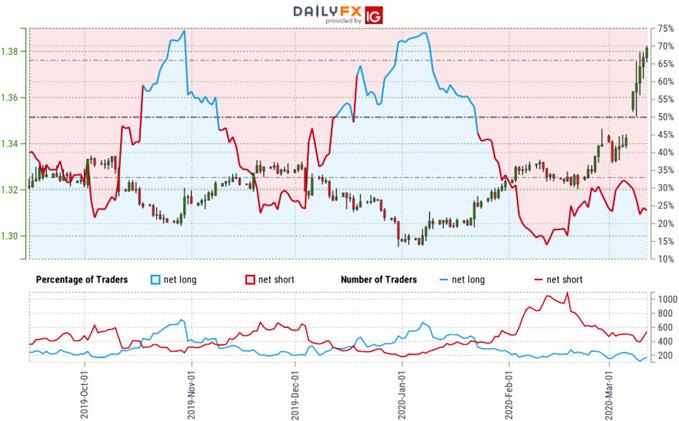

Canadian Dollar Trader Sentiment – USD/CAD Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -3.03 (24.80% of traders are long) – bullish reading

- Long positions are5.00% higher than yesterday and 39.42% lower from last week

- Short positions are13.92% higher than yesterday and 10.40% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -11% | -5% |

| Weekly | 12% | -18% | -8% |

---

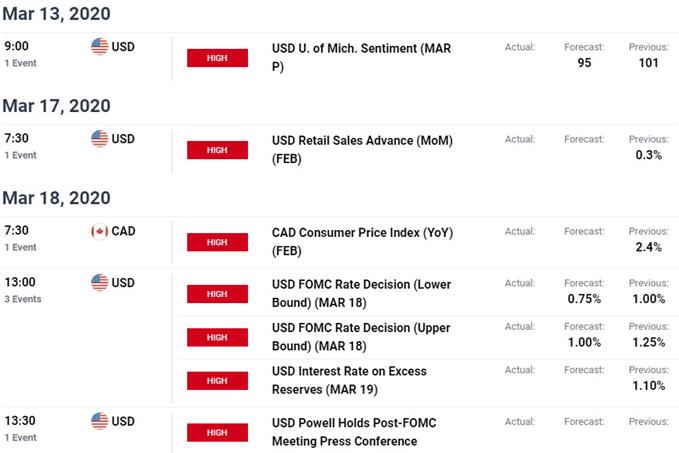

Key US / Canada Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- Gold (XAU/USD)

- Mexican Peso (USD/MXN)

- Euro (EUR/USD)

- US Dollar (DXY)

- British Pound (GBP/USD)

- Crude Oil (WTI)

- New Zealand Dollar (NZD/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex