Canadian Dollar Technical Highlights:

- Canadian Dollar jumps on crude oil spike

- Near-term picture uncertain, working towards larger breakout

Check out the intermediate-term fundamental and technical outlook for major markets and currencies in the DailyFX Quarterly Forecasts.

Canadian Dollar jumps on crude oil spike

Crude oil opened the week with a massive, double-digit percentage gap higher following drone attacks on a Saudi oil facility. With crude oil ripping, the Canadian Dollar is getting a bit of a lift. From a technical standpoint, the gap has done little to change the chart in USDCAD.

The near-term picture remains just as uncertain as it was on Friday. Getting a handle on USDCAD has been challenging lately with trading mostly dominated by choppy price action and limited follow-through when it does get into gear a bit.

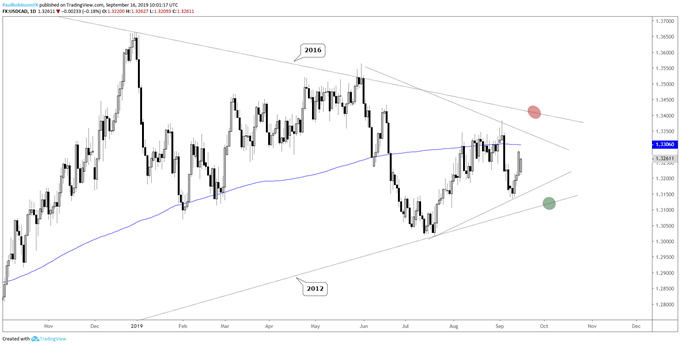

Looking longer-term, though, a major breakout could be nearing as long-term trend-lines converge on one another. On the underside there is the 2012 trend-line which was tested in July and very nearly again last week. It has a good number of connecting points, making it a sturdy line for USDCAD to lean on as support.

Crossing down from the 2016 spike-high is another trend-line making its way over peaks in December and May. The convergence of the two lines is very near, which means the risk of seeing a sustained breakout has significantly increased.

The thinking on this end for a while has been that the grind higher since the bottom in 2017 could lead to another downside move like the periods of selling in 2016 and 2017. But as long as the 2012 trend-line holds this view is in the neutral zone. A break below the trend-line and July low of 13015 will be needed to turn the outlook firmly negative.

On the topside, a breakout above the 2016 trend-line and December high at 13661 is seen as turning the picture positive. Otherwise only a sneak above the 2016 trend-line without climbing above the December high could lead to a further contraction in price since May 2017 and a triangle formation that will need a little more time to develop.

From a tactical standpoint, traders aren’t left with a lot to work with in the very near-term, but a longer-term breakout could soon bring a sizable move and a decisive trading direction. The downside is seen as having the cleanest path, but again waiting for confirmation may best serve traders.

USDCAD Weekly Chart (Convergence to lead to big move)

USDCAD Daily Chart (Short-term uncertain)

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX