USD/CAD Price Forecast

- US Dollar to Canadian Dollar charts and analysis.

- USD/CAD price at its lowest level in eight and half months.

See the Q3 USD and Gold forecasts and learn what is likely to drive price action through this time of the year.

USD/CAD – The Seller’s Opportunity

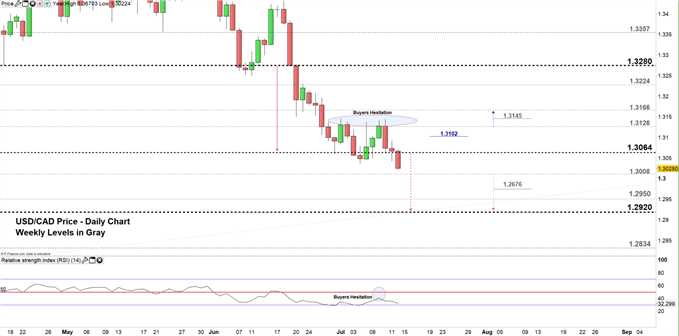

Since the start of July, USD/CAD in its most recent bullish efforts failed five times to overtake 1.3145, effectively capping any productive positive momentum. On Wednesday, the Sellers took the initiative to press the price lower after hearing BOC and Fed Powell .

Alongside, the Relative Strength Index (RSI) rose from below 30 and before testing 50 pointed lower indicating to the buyer’s weakness to start an uptrend momentum.

Having trouble with your trading strategy? Here’s the #1 Mistake That Traders Make

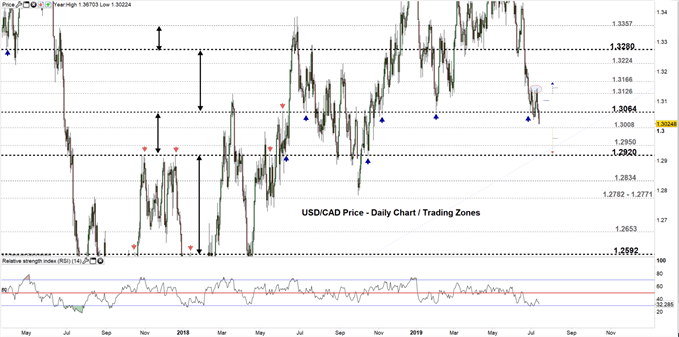

USD/CAD DAILY PRICE CHART (May 30, 2017 – July 12, 2019) Zoomed Out

USD/CAD DAILY PRICE CHART (April 17 – JULy 12, 2019) Zoomed In

Looking at the daily chart we notice today USD/CAD broke below the July 4 low at 1.3037 eyeing a test of 1.3008. A close below this level may send the price towards 1.2920, nonetheless; the weekly support levels marked on the chart (zoomed in) need to be watched closely.

Its worth noting that further bearishness may require a close below the highly important 1.2920 See the chart (zoomed out).

In turn, a failure in closing below 1.3008 could cause a rally towards 1.3064, although the daily resistance at 1.3048-50 needs to be kept in focus.

Just getting started? See our Beginners’ Guide for FX traders

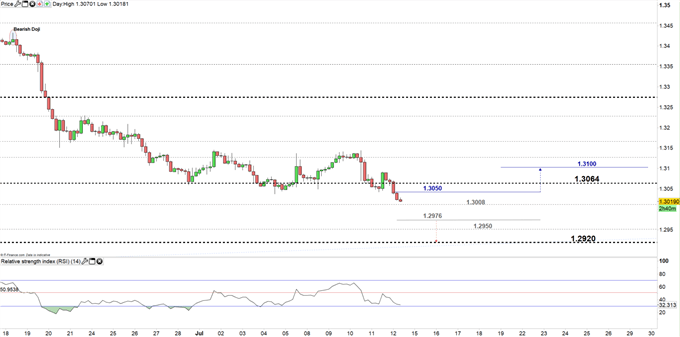

USD/CAD Four-HOUR PRICE CHART (June 17 – JuL 12, 2019)

Looking at the four-hour chart we notice since the start of the month USD/CAD has been moving in a narrow trading zone. Today, the pair has left this zone, therefore; a break below 1.2976 could send the price towards 1.2920, however; the weekly support at 1.2950 would be worth monitoring.

On the flip-side, a break above 1.3050 may cause a rally towards 1.3100, although; the daily resistance at 1.3064 needs to be considered.

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi