Canadian Dollar Rate Forecast Key Takeaways:

- USD/CAD Price Forecast: coming into 61.8% retracement of key March-April range

- CA Feb GDP beats expectations, helping CAD retain the best performer spot of Q2

- IG UK Client Sentiment Highlight: Retail selling activity jumps, bullish bias emerges

Huh? It’s not exactly Eureka, but the outcomes can be just as profound.

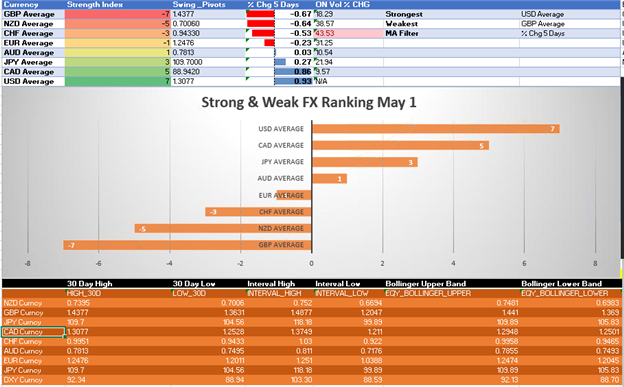

That was my sentiment when I realized that despite the sharp USD/CAD pullback in recent weeks, the Canadian Dollar remained the strongest G10 currency in Q2 after one month was in the books. Over the last five trading days, an equally weighted CAD index has just underperformed the stellar US Dollar with the weakest FX players being Sterling Pound, New Zealand Dollar, and the Swiss Franc.

Strong-WeakFX Reading – May 1, 2018

Data source: Bloomberg

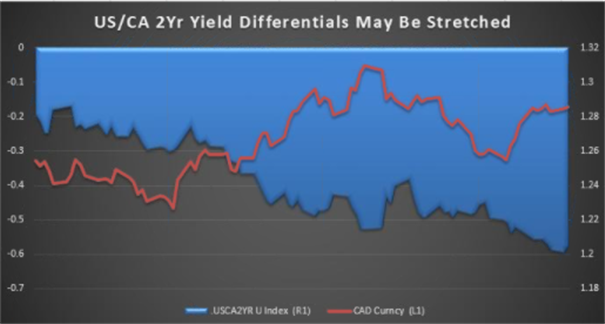

Recently, the Canadian Dollar has seen it’s 2-year yield spread widen to nearly 60bps as the Bank of Canada lost the market’s faith that a hike was imminent. The last time the 2-yr treasury yield spread was 60bps was early 2016 when USD/CAD was trading north of 1.40 CAD per USD. A narrowing of this relationship could bring back the CAD bulls, which are easiest to see at work against GBP

US/CA 2Yr Yield Differentials Are A Key Factor in FX Rate Direction

Unlock our Q2 forecast to learn what will drive trends for the US Dollar

Today, BoC Governor Poloz will speak on household indebtedness, a common struggle for economies like Sweden, New Zealand, and Australia. Despite the beat on GDP that may show the soft-patch of Economic data is over for CA, the focus will be on whether Poloz carries forward the dovish tone from the previous BoC meeting.

The market is currently pricing in a 38% chance of 25bp hike at the May 30 meeting. Any shift in that probability would be expected to have a firm effect on CAD.

Do you follow WTI crude oil? If so, do check out our popular Oil Forecast

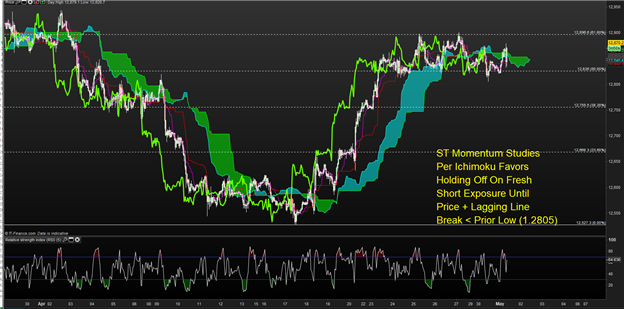

Technical Focus on the Canadian Dollar – USD/CAD Breaks 12-month Average, Looks Higher

Chart Source: IG Charting Package, IG UK Price Feed. Created by Tyler Yell, CMT

The broader daily chart above shows that USD/CAD has recently traded into the 61.8% retracement at 1.2898 of the March-April range. Given the sharp pull-back, traders should be on edge for the next move as the winner of this battle will likely be the low-hanging fruit to buy against weaker FX.

Last time, I shared that USD/CAD was consolidating near the 12-month average near 1.2780. A break back below this level could indicate a continuation of CAD strength and/ or a reprisal of USD weakness.

A break above 1.2900 (April 27 high) would open up a move toward the April 3 high of 1.2924.

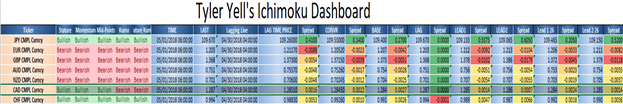

Intraday Ichimoku Dashboard - Hourly Data - Majors FX

Source: Ichimoku Intraday Dashboard

Chart Source: IG Charting Package, IG UK Price Feed. Created by Tyler Yell, CMT

Shorter-term focus remains on trend and momentum per Ichimoku cloud as the price bumps up against Fibonacci retracement resistance. A break below the prior low on the short-term chart at 1.2805 could open up a move toward the April 20 high of 1.2760 before retracing more of the post-BoC move.

Not familiar with Fibonacci analysis, check out this insightful article

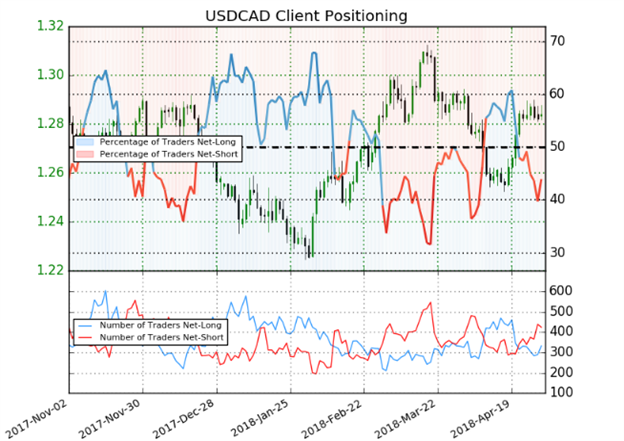

Valuable Insight from IG Client Positioning for USD/CAD: Retail selling activity jumps, biased higher

Data source: IG Client Positioning

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bullish contrarian trading bias.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell

Join Tyler’s distribution list.